Agreed Value Car Insurance for Daily Drivers

Agreed value car insurance can be a smart choice for classic car owners who use their prized possessions for daily driving. This type of coverage offers a pre-determined value for your vehicle, agreed upon between you and the insurer, which provides a significant advantage over standard insurance policies in the event of a total loss. Instead of receiving the depreciated market value, you receive the agreed-upon sum, ensuring you have the resources to replace or repair your classic car.

Understanding the Need for Agreed Value Car Insurance

Traditional car insurance policies determine a vehicle’s value based on its depreciated market value at the time of the loss. This can be a major issue for classic car owners, especially those who drive their vehicles regularly. While a daily driver may accumulate mileage and experience wear and tear, its value to the owner often transcends the market’s assessment. This is where agreed value car insurance comes into play. It protects your investment by guaranteeing a fixed payout, reflecting the true worth of your classic.

Why Market Value Falls Short for Classic Cars

Market value fluctuates, and it doesn’t always consider the sentimental value, restoration costs, or the unique nature of a classic car. Factors like rarity, modifications, and even historical significance can contribute to a car’s value, elements often overlooked in standard valuations. Imagine spending years meticulously restoring a vintage Mustang, only to have it totaled and receive a market value settlement that barely covers the cost of a new economy car. Agreed value insurance prevents this scenario, ensuring you receive the agreed-upon amount, allowing you to properly restore or replace your beloved classic.

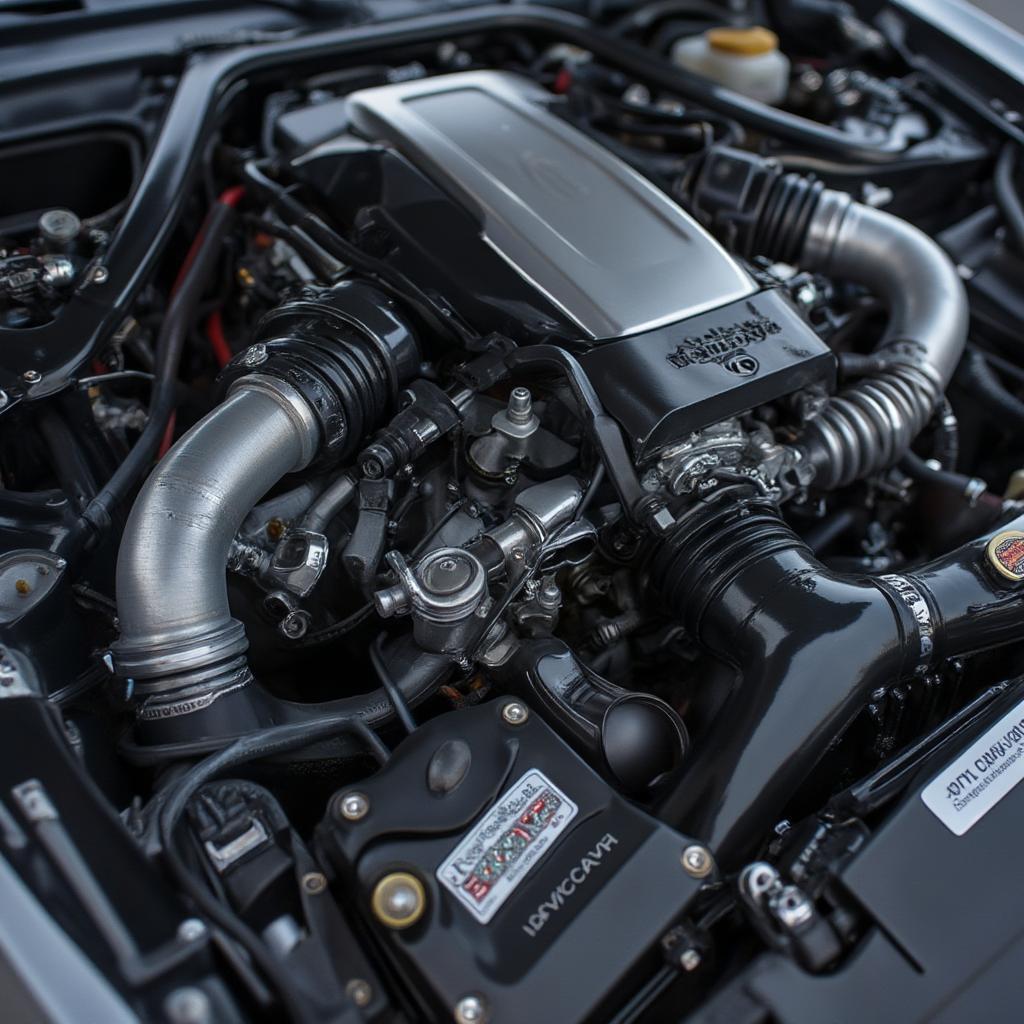

How Agreed Value Car Insurance Works for Daily Drivers

The process of obtaining agreed value insurance usually begins with an appraisal. A qualified appraiser will assess your car’s condition, taking into account its age, mileage, modifications, and overall value in the classic car market. This appraisal becomes the basis for the agreed value, which is then documented in your insurance policy. The premium you pay will be based on this agreed value, and it’s often higher than standard insurance due to the guaranteed payout.

The Appraisal Process: A Crucial Step

The appraisal is the cornerstone of agreed value insurance. It’s crucial to choose a reputable and experienced appraiser who specializes in classic cars. They will meticulously document the vehicle’s condition, providing a comprehensive report that justifies the agreed-upon value. This report becomes an essential piece of documentation for your insurance claim in case of a total loss.

Factors Affecting Premiums for Daily Driven Classics

While agreed value insurance offers superior protection, it’s important to be aware that premiums can be influenced by several factors specific to daily driven classics. Mileage is a significant consideration, as higher mileage can lead to increased premiums. Your driving history and the car’s storage arrangements also play a role. Secure garage storage often leads to lower premiums compared to on-street parking.

Benefits of Agreed Value for Your Classic Daily Driver

The primary benefit of agreed value insurance is the peace of mind knowing you’re protected in the event of a total loss. Beyond the guaranteed payout, this type of coverage often includes benefits tailored for classic car owners, like coverage for spare parts and accessories.

Protecting Your Investment and Passion

Agreed value insurance is more than just financial protection; it’s about safeguarding your passion. Classic cars often represent a significant emotional investment, and their loss can be devastating. Knowing you have the resources to restore or replace your cherished vehicle provides immeasurable peace of mind.

“Agreed value insurance offers peace of mind knowing you’ll receive the proper compensation if your classic is totaled, allowing you to focus on enjoying the drive, not worrying about the ‘what ifs’,” says Amelia Carter, a Classic Car Insurance Specialist at Heritage Auto Insurance Group.

Choosing the Right Agreed Value Insurance Provider

Not all insurance providers offer agreed value coverage, and those that do may have different terms and conditions. It’s crucial to shop around, comparing quotes and coverage options from multiple insurers. Look for insurers specializing in classic cars, as they understand the nuances of these vehicles and can tailor coverage to your specific needs.

Key Considerations When Selecting an Insurer

When evaluating insurers, consider their reputation, financial stability, and claims process. Read reviews and speak with other classic car owners to gather insights into their experiences. A smooth and efficient claims process is vital, especially during a stressful time like a total loss.

“Don’t just look at the price; examine the policy details. Make sure the coverage aligns with your specific needs and driving habits. A specialist in classic car insurance can guide you through the options,” advises Richard Morrison, a Classic Car Appraiser at Vintage Auto Appraisals.

Conclusion

Agreed value car insurance is a crucial investment for owners of daily driven classic cars. It provides financial security and peace of mind, knowing your prized possession is protected at its true value. While premiums might be slightly higher than standard insurance, the guaranteed payout and specialized coverage make it a worthwhile investment for those who cherish their classic vehicles and understand their irreplaceable worth. Don’t let depreciation diminish the value of your classic; protect it with agreed value car insurance.

FAQ

- What is the difference between agreed value and stated value insurance?

- How often does my classic car need to be appraised for agreed value insurance?

- Can I use my classic car for daily driving with agreed value insurance?

- What factors affect the agreed value of my classic car?

- What happens if my classic car is damaged but not totaled with agreed value insurance?

- Does agreed value insurance cover modifications and aftermarket parts?

- How do I find a reputable classic car appraiser?