Insuring Your Pride and Joy: A Guide to Alfa Romeo Classic Car Insurance

Owning a classic Alfa Romeo is more than just having a car; it’s owning a piece of automotive history, a rolling sculpture of passion and engineering. But with such a prized possession comes the responsibility of ensuring it’s adequately protected. Navigating the world of Alfa Romeo Classic Car Insurance can feel daunting, but understanding the nuances is crucial. This article will guide you through everything you need to know about insuring your cherished vintage Alfa, ensuring you can enjoy it worry-free.

Why Classic Alfa Romeos Need Specialized Insurance

Unlike your everyday commuter car, classic Alfa Romeos require specialized insurance because their value isn’t solely based on age and depreciation. Several factors contribute to this:

- Appreciating Value: Unlike modern cars, classic Alfa Romeos often increase in value over time, particularly rare or well-maintained models. Standard insurance policies may not cover this appreciation.

- Unique Parts and Repair: Finding parts for older Alfa Romeos can be challenging and expensive. Specialized insurance often covers the cost of sourcing rare parts and using specialist mechanics.

- Limited Usage: Classic cars are often driven less frequently than modern vehicles, and insurance policies designed for this limited usage reflect this.

- Sentimental Value: Beyond the monetary value, these cars often hold sentimental significance for their owners. Specialized insurance takes this into account, offering coverage that goes beyond mere replacement value.

Types of Alfa Romeo Classic Car Insurance Coverage

Understanding the different types of coverage available is key to finding the right policy for your Alfa Romeo. Here’s a rundown:

- Agreed Value Coverage: This is perhaps the most crucial type for classic cars. Instead of relying on the insurance company’s assessment of your car’s value at the time of a claim, you and the insurer agree on a specific value beforehand. This ensures you receive the full agreed amount in the event of a total loss, regardless of current market conditions.

- Liability Coverage: Like any car insurance, this covers damages and injuries you cause to other people or property in an accident. It’s a legal requirement, but the coverage limits should align with the potential risks involved in owning a valuable classic car.

- Comprehensive Coverage: This protects your Alfa Romeo from damages caused by things other than collisions, such as theft, vandalism, fire, or natural disasters. The specific terms of coverage are vital to understand, ensuring you’re protected from a broad range of unforeseen events.

- Collision Coverage: This covers damage to your Alfa Romeo if you’re involved in an accident, regardless of who is at fault. It’s an important consideration given the potential for accidents, especially if participating in classic car events or driving on public roads.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re hit by a driver without insurance or with insufficient coverage to pay for your damages. Given the scarcity of parts and the high cost of repairs for classic cars, this is another vital aspect to consider.

- Roadside Assistance: Look for policies that include specific coverage for classic cars, as a regular tow truck might not have the right equipment to handle your cherished Alfa properly.

“When insuring a classic Alfa Romeo, you’re not just buying a policy, you’re protecting a legacy,” explains Alessandro Bellini, a renowned classic car restorer. “Agreed value coverage is non-negotiable. You want to be certain that the insurance reflects the true worth of your car, not a depreciated figure.”

Key Factors Affecting Alfa Romeo Classic Car Insurance Rates

Several factors will influence the cost of your Alfa Romeo classic car insurance. Here are some key elements:

- Vehicle Age and Model: Older and rarer Alfa Romeos typically command higher premiums due to their increased value and the difficulty of obtaining replacement parts. The specific model, such as a Giulia Sprint or a Spider, can significantly affect the cost.

- Vehicle Condition: The better your Alfa Romeo’s condition, the lower your premiums will likely be. Cars that have been professionally restored and maintained are seen as a lower risk.

- Mileage: The less you drive your classic car, the lower your premium is likely to be, as reduced use means a lower risk of an accident.

- Storage Location: Where you store your Alfa Romeo significantly impacts your insurance rates. Keeping it in a secure, enclosed garage is preferable to storing it outside, as this reduces the likelihood of damage or theft.

- Driving Record: Your personal driving record is a key consideration. If you have a clean history, you’ll typically qualify for lower rates, while accidents or moving violations can increase your premiums.

- Level of Coverage: The specific types and limits of coverage you choose will directly affect the overall price of the insurance. Opting for higher limits and more comprehensive coverage will result in a higher premium.

- Insurer: Different insurers will have different rating factors, so it is essential to get multiple quotes to find the most competitive pricing and coverage.

How to Find the Right Alfa Romeo Classic Car Insurance Provider

Finding the right insurance provider for your Alfa Romeo takes some research. Here’s how to approach it:

- Research Specialized Insurers: Seek out insurance companies specializing in classic and vintage vehicles. These insurers understand the nuances of classic car ownership and are more likely to offer policies tailored to your needs.

- Compare Multiple Quotes: Get quotes from several different insurers to ensure you’re getting the best value for your money. Don’t settle for the first quote you receive.

- Check Reviews and Testimonials: Look for online reviews and testimonials from other classic car owners. This can give you valuable insights into the quality of service and reliability of the insurer.

- Review Policy Details: Don’t simply focus on price. Scrutinize the policy details to ensure it offers the coverage you need, including agreed value, comprehensive coverage, and specialized roadside assistance.

- Ask Questions: Don’t hesitate to ask the insurance agent questions about any aspects of the policy you’re unsure about. A reputable insurer will be happy to provide clear and comprehensive answers.

Tips for Lowering Your Alfa Romeo Classic Car Insurance Premiums

While you cannot control the age or model of your Alfa Romeo, you can take steps to lower your insurance premiums:

- Improve Storage: Keeping your car in a secure garage or storage unit can significantly reduce the risk of theft or damage, leading to lower premiums.

- Drive Less: Limiting your mileage can help you qualify for lower premiums. Consider using your classic car primarily for shows and events rather than daily transportation.

- Join a Classic Car Club: Membership in a classic car club can sometimes result in discounted insurance rates from some providers.

- Install Security Measures: Installing an alarm system, immobilizer, or GPS tracking device can reduce the risk of theft and lower your insurance rates.

- Maintain Your Car Well: A well-maintained car is seen as a lower risk. Consistent maintenance can reduce the chances of accidents caused by mechanical failures.

- Increase Deductible: Opting for a higher deductible will reduce your premiums, though you will need to pay more out-of-pocket in the event of a claim.

The Importance of Agreed Value Coverage

The cornerstone of insuring a classic Alfa Romeo is agreed value coverage. Without this, you could be severely undercompensated in the event of a total loss. Here’s why it’s so important:

- Market Fluctuations: The value of classic cars can fluctuate significantly. What your car was worth a year ago might not be the same now. Agreed value coverage locks in the price, so you are paid based on an agreed amount at the time of the policy, not a depreciated current market value.

- Restoration Investments: If you’ve invested significantly in restoring your Alfa Romeo, an agreed value policy will account for these improvements.

- Peace of Mind: Knowing the agreed value gives you the confidence that you’re adequately protected. It removes the uncertainty and potential frustration of dealing with a market-value claim.

- Expert Assessment: Insurers offering agreed value coverage will often request appraisals from qualified specialists, ensuring that the agreed value is fair and accurate.

“Agreed value is absolutely critical,” asserts Dr. Eleanor Vance, an automotive historian specializing in Italian marques. “Without it, you’re at the mercy of market forces, and standard insurers often undervalue these classics. Ensure the insurer uses a reputable appraiser specializing in Italian vintage cars.”

How Classic Car Insurance Differs from Regular Car Insurance

It’s important to understand that classic car insurance is different from regular insurance in several key aspects:

- Valuation Method: As discussed, classic car insurance uses agreed value coverage, while standard insurance uses depreciated value.

- Usage Restrictions: Classic car policies often come with mileage limitations and may restrict usage to certain types of events or shows.

- Coverage Types: Classic car insurance typically offers coverage types tailored to the unique needs of classic vehicles, such as coverage for rare parts and specialized repairs.

- Claim Process: The claim process for classic car insurance often involves working with specialist adjusters who understand the unique nature of these cars.

- Premiums: While it may seem counterintuitive, classic car insurance premiums can be lower than those for everyday cars, especially when mileage and usage are limited.

- Flexibility: Classic car insurance is often more flexible in terms of usage patterns, allowing for occasional use as opposed to daily commuting.

You might be interested in exploring our selection of historic race cars for sale, showcasing the performance side of classic car ownership.

Documentation for Obtaining Alfa Romeo Classic Car Insurance

When you’re ready to apply for Alfa Romeo classic car insurance, be prepared to provide the following documentation:

- Vehicle Information: Details such as the year, make, model, and VIN (Vehicle Identification Number).

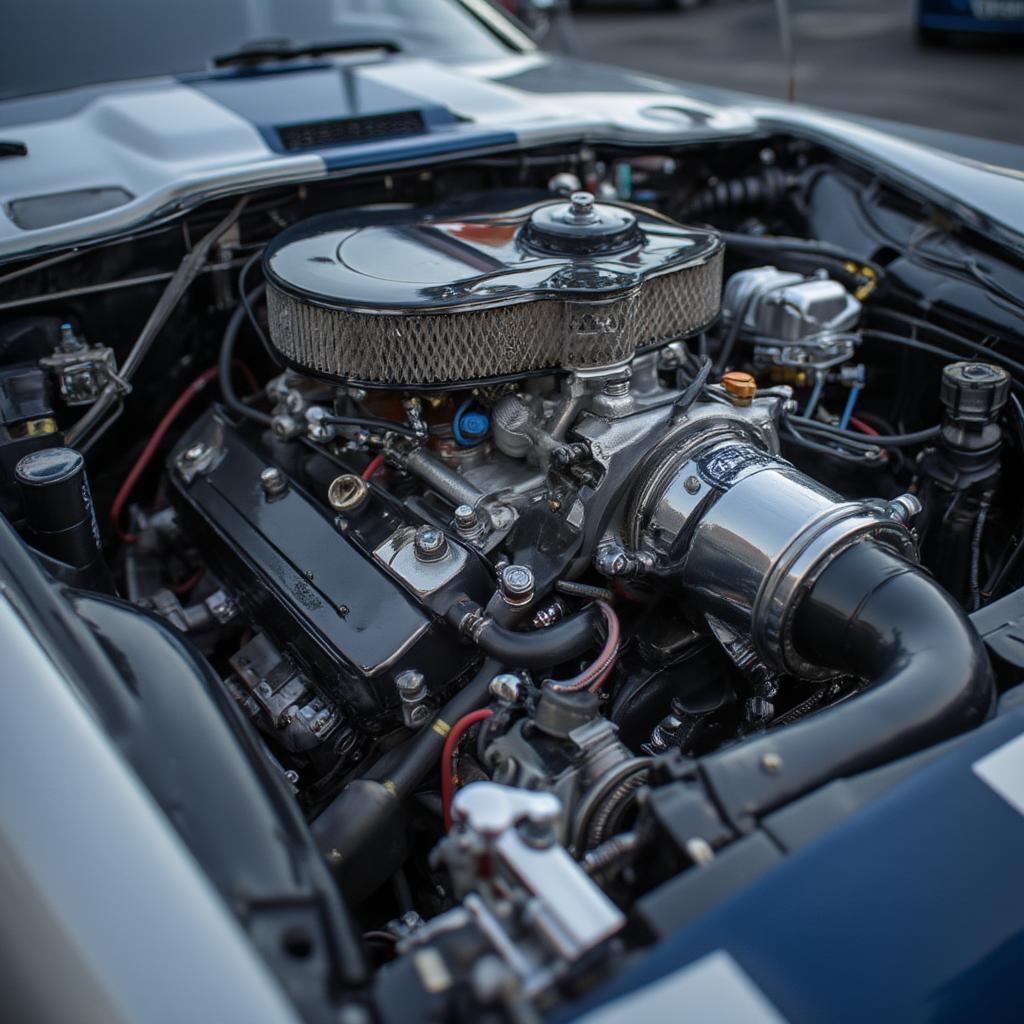

- Photographs: Photos of your Alfa Romeo, showing its overall condition, interior, and exterior.

- Appraisal: An appraisal from a qualified classic car specialist is crucial to establishing the agreed value of your vehicle.

- Restoration Records: Documentation of any restoration work, including receipts for parts and labor.

- Ownership Proof: Documents proving your ownership of the vehicle, such as a title or registration.

- Driver’s Information: Your driving history, including any accidents or moving violations.

- Storage Information: Proof of the location where your vehicle will be stored.

For those looking to add to their collection, browse our collection of classic alfa romeo for sale.

Conclusion

Insuring your classic Alfa Romeo is an essential step in protecting your investment and enjoying your vehicle to the fullest. With the right coverage, you can drive with confidence, knowing that you are protected against the unexpected. Understanding the specific needs of classic cars and choosing a specialized insurer is the key to finding the perfect Alfa Romeo classic car insurance policy. By taking the time to research and compare different options, you can ensure that your beloved Alfa is safe and secure for years to come.

FAQ:

- What is “agreed value” coverage and why is it important? Agreed value coverage means that the insurer and you agree on a specific value for your Alfa Romeo before the policy is put in place, thus assuring that you will receive the total agreed upon amount in the case of a total loss.

- How do I find a reliable insurer for my classic Alfa Romeo? Search for insurers that specialize in classic or vintage vehicles. Check online reviews and get multiple quotes before deciding.

- Does it cost more to insure a classic car than a modern car? While this is counter-intuitive, it’s possible to get a lower premium on your classic Alfa if you keep it in good condition, limit your mileage and use it mainly for events and shows rather than daily transportation.

- What type of documentation is needed to obtain classic car insurance? Be prepared to provide all details of your vehicle (year, make, model, VIN), photos of the car, an appraisal from a qualified classic car specialist and records of restoration, along with proof of ownership.

- Can I get roadside assistance coverage for my classic Alfa? Yes, it’s highly recommended to get roadside assistance coverage that specializes in classic vehicles, as regular tow trucks may not have the tools or expertise to handle your vintage car correctly.

- How can I lower the cost of my Alfa Romeo classic car insurance? You can lower your premiums by keeping your vehicle in a secure garage, limiting your mileage, joining a classic car club, installing security measures, increasing your deductible and keeping up with your car’s maintenance.

- Is it necessary to have a professional appraisal for my classic Alfa Romeo? Yes, a professional appraisal by a specialist is vital to determine the accurate value of your vehicle and ensure you are adequately covered with an agreed value policy.