American Bankers Classic Car Insurance: A Comprehensive Guide

Classic cars represent more than just transportation; they are tangible pieces of automotive history, embodying design, engineering, and cultural shifts of bygone eras. Owning a classic car is a privilege, and protecting your investment with the right insurance is paramount. That’s why understanding American Bankers Classic Car Insurance is crucial.

Understanding the Nuances of Classic Car Insurance

Unlike standard auto insurance, classic car insurance recognizes the unique nature of these vehicles. It acknowledges that classic cars are often not daily drivers, are meticulously maintained, and appreciate in value rather than depreciate. This understanding translates into specialized coverage options tailored to the needs of classic car owners. Choosing the right classic car insurance policy can be the difference between peace of mind and financial hardship should the unexpected occur.

Why American Bankers Classic Car Insurance Stands Out

American bankers classic car insurance offers a range of benefits that cater specifically to classic car enthusiasts. Their policies often include agreed value coverage, which means that you and the insurer agree on the value of your car upfront. This eliminates the hassle of haggling over the car’s worth in the event of a total loss. Moreover, American bankers classic car insurance policies typically offer flexible mileage restrictions, recognizing that classic cars are often driven less than everyday vehicles.

Key Features of American Bankers Classic Car Insurance

Several key features distinguish American bankers classic car insurance from standard auto policies. These include:

- Agreed Value Coverage: As mentioned earlier, this crucial feature protects your investment by pre-determining the car’s value.

- Flexible Mileage Options: Policies cater to limited usage, offering customized mileage options to match your driving habits.

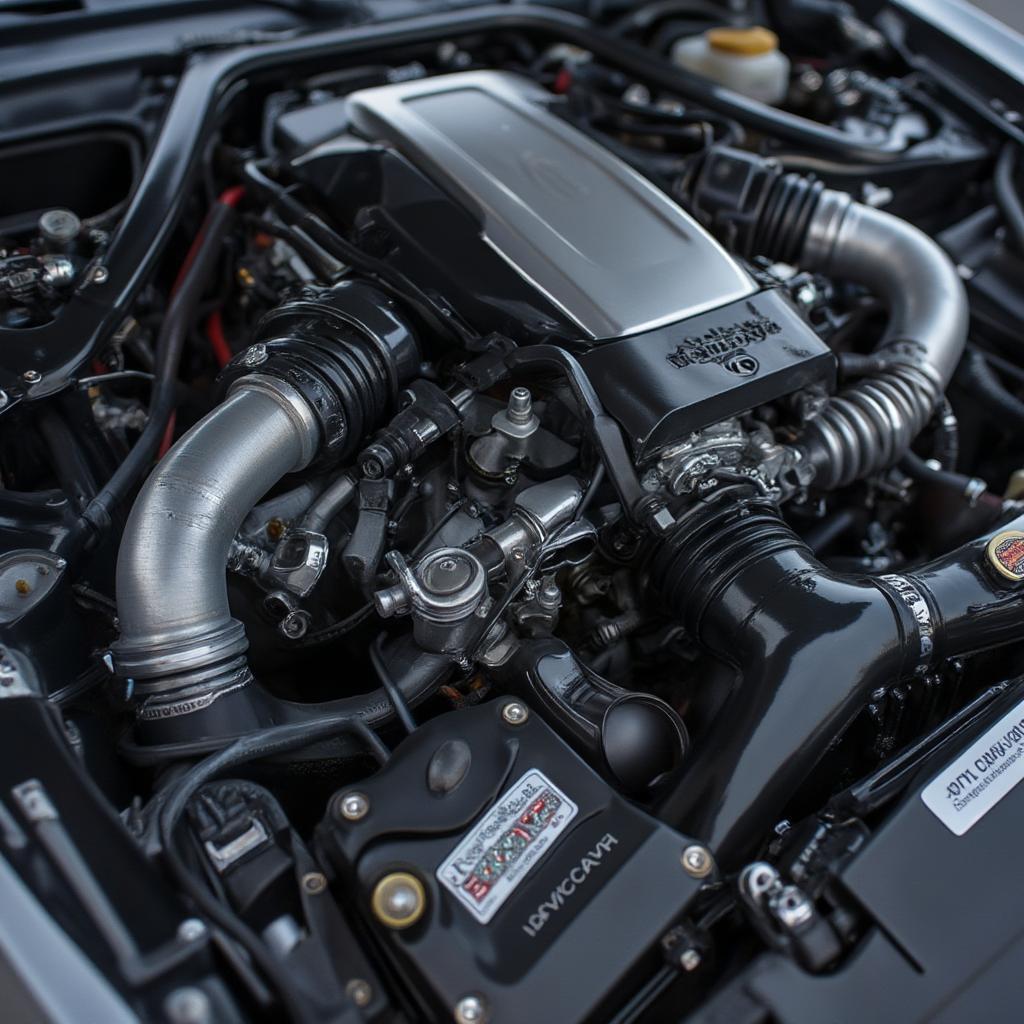

- Specialized Repair Shops: Coverage often includes the option to choose specialized repair shops experienced in working with classic cars.

- Roadside Assistance: Tailored roadside assistance programs understand the specific needs of classic cars, ensuring proper handling and towing.

- Parts Coverage: Policies may include coverage for spare parts, a valuable benefit considering the rarity of some classic car components.

Choosing the Right Coverage for Your Classic

When selecting an American bankers classic car insurance policy, consider factors such as the car’s value, how often you drive it, and the level of coverage you require. Consulting with an insurance specialist who understands classic cars is essential. They can guide you through the process and help you determine the most suitable policy for your prized possession.

Common Questions About Classic Car Insurance

What are the typical mileage restrictions? Mileage restrictions vary depending on the policy and insurer. Some policies offer unlimited mileage options.

Is classic car insurance more expensive than regular auto insurance? Not necessarily. Due to the limited usage and careful maintenance of classic cars, premiums can often be lower than standard auto insurance.

What qualifies a car as a classic? The definition of a classic car can vary between insurers. Generally, it refers to older vehicles, often 20 years or older, that are considered collectible or historically significant.

Do I need specialized insurance for my antique car? Yes, specialized insurance is highly recommended for antique cars. It provides tailored coverage that protects your valuable investment.

What factors affect classic car insurance premiums? Factors such as the car’s value, its age, your driving history, and the level of coverage you choose can all influence premiums.

Expert Insights on Classic Car Insurance

James Montgomery, Classic Car Appraiser and Restoration Specialist: “Protecting your classic car with specialized insurance is not just a smart financial move; it’s an act of preservation. These vehicles are more than just cars; they are pieces of history.”

Sarah Chen, Insurance Broker Specializing in Classic Cars: “Choosing the right classic car insurance policy can be complex. Working with a knowledgeable broker can help you navigate the options and find the best coverage for your specific needs.”

The Importance of Research and Due Diligence

Before purchasing any classic car insurance policy, thorough research and due diligence are vital. Comparing quotes from different insurers, reading policy documents carefully, and seeking expert advice are crucial steps in making an informed decision.

Securing Your Classic Car’s Future

American bankers classic car insurance provides specialized coverage options designed to protect your cherished investment. By understanding the nuances of classic car insurance and choosing the right policy, you can safeguard your classic car’s future and enjoy the open road with peace of mind.

Conclusion: Protect Your Piece of Automotive History with American Bankers Classic Car Insurance.

Investing in American bankers classic car insurance is more than just buying a policy; it’s about protecting a passion, a piece of automotive history. By securing the right coverage, you’re not only safeguarding your financial investment but also contributing to the preservation of these timeless machines. With a tailored policy, you can continue to enjoy the thrill of owning and driving your classic car for years to come.

FAQ: Your Classic Car Insurance Questions Answered

- What is agreed value coverage? Agreed value coverage ensures you receive the pre-agreed value of your car in the event of a total loss, eliminating depreciation concerns.

- Does classic car insurance cover track days? Coverage for track days varies depending on the policy; some offer specific options or endorsements.

- How do I determine the value of my classic car for insurance purposes? Appraisals from qualified classic car experts are typically used to determine the insured value.

- Can I modify my classic car and still be insured? Modifications can affect your coverage, so it’s essential to inform your insurer of any changes.

- What discounts are available for classic car insurance? Discounts might be available for things like belonging to a classic car club or having multiple classic cars insured.

- How often should I review my classic car insurance policy? Reviewing your policy annually or whenever your car’s value changes is recommended.

- Are there limitations on who can drive my classic car under the insurance policy? Policies typically specify who is covered to drive the vehicle.