Unveiling the Best Crypto 2022: A Comprehensive Guide for Investors

The year 2022 was a rollercoaster for the cryptocurrency market, marked by significant highs and lows. For investors, navigating this volatility required careful analysis and a keen understanding of market trends. Identifying the Best Crypto 2022 wasn’t a matter of guesswork but rather a result of meticulous research and strategic decision-making. This article will delve into the factors that made certain cryptocurrencies stand out in 2022, offering insights that remain relevant for understanding the market today.

Understanding the 2022 Crypto Landscape

The crypto market in 2022 was characterized by both innovation and instability. We saw the emergence of new projects, the collapse of established ones, and a constant shift in investor sentiment. To understand which cryptocurrencies performed well, we need to consider several key factors:

- Technological Innovation: Cryptocurrencies with strong underlying technology and innovative use cases often garnered more attention and investor interest.

- Community Support: A vibrant and active community can contribute significantly to the success of a crypto project.

- Market Sentiment: Overall market conditions and investor confidence played a significant role in the performance of various cryptocurrencies.

- Real-World Adoption: Cryptocurrencies that saw increased real-world adoption in terms of payments and applications tended to perform better.

Top Performing Cryptocurrencies in 2022

Identifying the absolute “best” is subjective and depends on individual investment goals. However, a few cryptocurrencies stood out due to their resilience, innovation, or significant growth in 2022. Understanding their performance provides a valuable insight into what factors contributed to success during a turbulent period.

Bitcoin (BTC): The Digital Gold Standard

As always, Bitcoin remained a significant player in the crypto space. While it experienced the overall market downturn, its status as a store of value and its widespread adoption continued to solidify its importance. It remains the benchmark against which all other cryptocurrencies are measured.

“Bitcoin’s resilience during 2022 demonstrated its enduring position in the market. Its fundamentals and network security continue to make it a core holding for many long-term investors,” notes Dr. Evelyn Reed, a prominent crypto economist and blockchain researcher.

Ethereum (ETH): The Smart Contract Pioneer

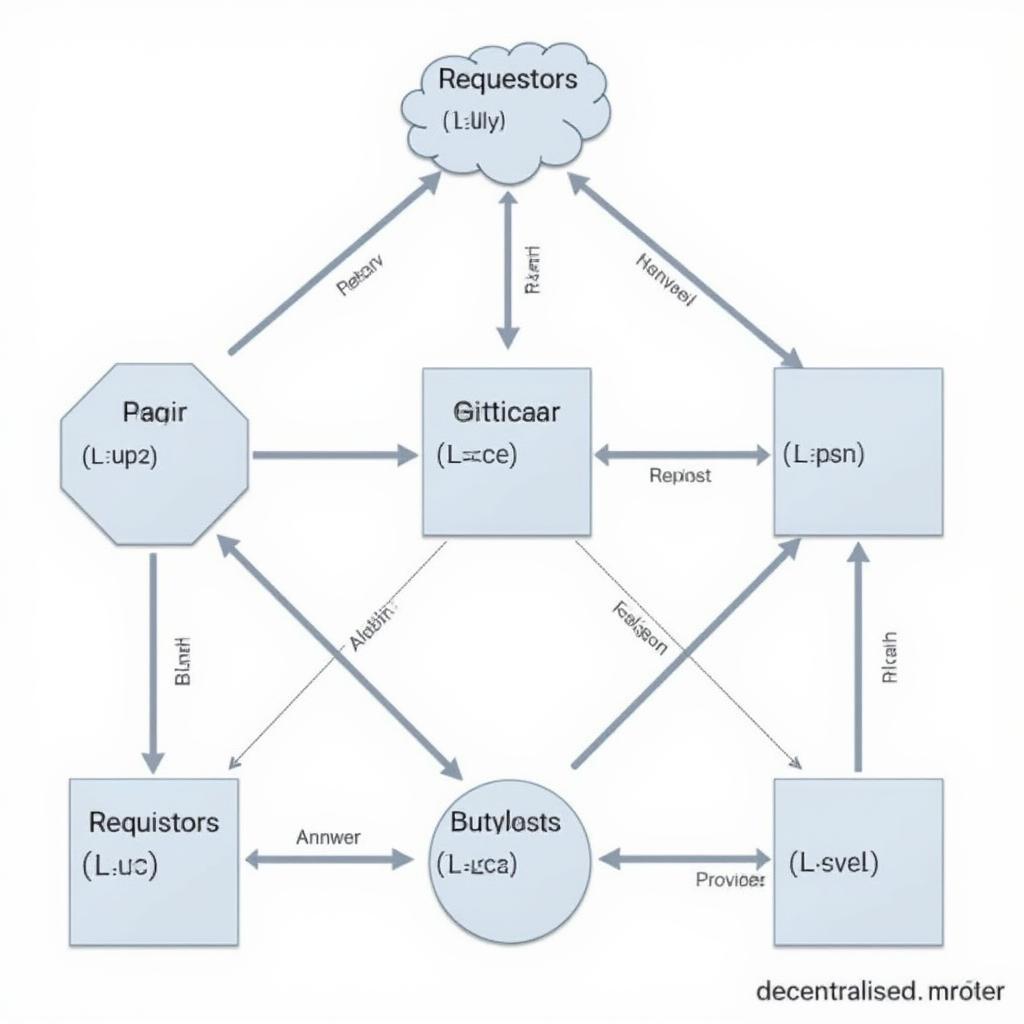

Ethereum’s transition to Proof-of-Stake was a monumental event that dominated headlines in 2022. While the transition came with a series of challenges, this upgrade was seen as a significant improvement in terms of energy efficiency and scalability. Ethereum continues to be the leading platform for decentralized applications and smart contracts, further cementing its importance in the crypto ecosystem.

Altcoins That Showed Promise

While the performance of Bitcoin and Ethereum remains central to the discussion, several alternative cryptocurrencies also demonstrated potential. Projects in the decentralized finance (DeFi) and metaverse sectors saw significant interest. For example, some Layer-2 scaling solutions that aimed to tackle Ethereum’s high transaction fees and slow speeds demonstrated substantial growth and adoption. Also, several Web3-focused cryptocurrencies started to show adoption traction, indicating the future of the internet is actively being built.

Factors Influencing the Best Crypto 2022 Performance

Understanding why certain cryptocurrencies performed well involves diving into specific driving forces. Here’s an examination of some key factors:

Technological Advancement and Use Cases

One of the primary reasons for the success of certain cryptocurrencies in 2022 was their technological innovation. Projects that aimed to solve real-world problems or introduced unique features tended to attract more investors. The expansion of DeFi and the metaverse generated interest in projects that were developing new solutions in those specific ecosystems.

The Impact of Market Sentiment

Bear markets are often a period for the most innovative and useful projects to stand out. They present an opportunity for the industry to mature and refocus on fundamentals instead of hype. The market’s overall feeling towards risk and volatility played a large part in how different cryptocurrencies performed.

Real-World Adoption and Integration

Cryptocurrencies that found practical applications in payments, supply chain management, and other real-world industries saw an increase in their value and credibility. The integration of crypto into traditional systems helped to build confidence in the long-term sustainability of the technology.

According to Professor Mark Olsen, a fintech expert specializing in blockchain technology, “The crypto market in 2022 showcased that adoption and integration with real-world systems can be a very influential factor in a project’s success and sustainability.”

Navigating the Market: Lessons from 2022

The experiences of 2022 provided critical lessons for both seasoned and new crypto investors. Here are a few key takeaways:

- Do Your Research (DYOR): Always perform thorough research on any cryptocurrency you consider investing in. Understand the underlying technology, the team behind the project, and its potential for long-term growth.

- Diversification: Don’t put all your eggs in one basket. Diversifying your portfolio across different cryptocurrencies can help mitigate risk.

- Long-Term Vision: Avoid impulsive reactions to short-term market fluctuations. Focus on the long-term potential of your investments.

- Risk Management: Invest only what you can afford to lose. Understand the risks involved in crypto investing and manage your portfolio accordingly.

What to Consider for Future Investments

While the best crypto 2022 provides insight into historical data, it’s more important to apply that knowledge to future opportunities.

- Innovation: Focus on projects that are pushing technological boundaries and offering unique solutions.

- Sustainability: Consider the long-term viability and sustainability of a project before investing.

- Adoption: Look for cryptocurrencies that are finding practical applications and are seeing increased adoption in the real world.

The Future of Crypto

The crypto market is constantly evolving. While 2022 was a volatile year, it also provided a window into which projects have the potential to stand the test of time. What made those projects the best crypto 2022 provides invaluable data for future success in the market. Staying informed, doing your research, and maintaining a long-term perspective are crucial elements to becoming a successful investor in the crypto space. To fully appreciate the crypto market it is also important to understand the potential of crypto to buy, to maximize profits.

Remember to always stay vigilant and only invest what you can afford to lose, but with research and careful planning, there is potential to benefit from the next generation of digital assets.

FAQ: Best Crypto 2022

What was the overall market trend for cryptocurrencies in 2022?

The year 2022 was marked by significant volatility, experiencing both highs and lows, with an overall bearish trend impacting most cryptocurrencies. Market sentiment was heavily influenced by global economic factors.

What made certain cryptocurrencies stand out in 2022?

Cryptocurrencies that demonstrated technological innovation, strong community support, real-world adoption, and resilience to market conditions performed better than others in 2022. The best crypto 2022 had solid fundamentals in those areas.

Was Bitcoin still a significant player in the crypto space in 2022?

Yes, Bitcoin remained a dominant player in the crypto market, maintaining its position as a store of value and the benchmark against which most other cryptocurrencies are measured. Its market share, while fluctuating, remained substantial.

How did Ethereum perform during its transition to Proof-of-Stake in 2022?

Ethereum’s transition to Proof-of-Stake was a major highlight, and though it came with short-term price volatility, the upgrade was overall viewed positively for its energy efficiency and long-term scalability improvements.

What are some key lessons learned from the crypto market in 2022?

Key lessons include the importance of thorough research, portfolio diversification, a long-term investment horizon, and sound risk management strategies. This helps to identify the best crypto 2022 projects that provide the most stable outlook.

Where can I find reliable information about crypto investments?

Reputable financial news outlets, blockchain research websites, and the official websites and whitepapers of specific crypto projects are good places to start your research. You should also keep up to date on what is going on in the market, for example, by following the trends on vis crypto.

How does the 2022 crypto market inform my 2023 crypto investment strategy?

The 2022 market highlights the importance of understanding and evaluating a project’s value proposition. For example, if you were considering gemini cryptocurrency it would be wise to look at what issues they faced previously, and see if those have been addressed. Also consider other, more general concepts, such as the volatility and risks associated with investing in the crypto space.

What factors should I consider for my future crypto investments?

You should prioritize innovation, long-term sustainability, and actual adoption in the real world. Ensure your project has tangible and unique value propositions to stand the test of time.

What should I consider if I’m planning on buying crypto in the future?

Remember the lessons learned during 2022, for instance, a project like terra coingecko, is a good reminder of how important a projects fundamentals are. Also consider only investing what you can afford to lose, and look at the potential risks involved with each investment.