Understanding Binance Card Limits: A Comprehensive Guide

Binance Card allows users to spend their cryptocurrencies at millions of merchants worldwide. However, understanding the Binance Card Limits is crucial for a seamless experience. These limits vary based on your card level and verification status, impacting how much you can spend, withdraw, and top up. This guide delves deep into Binance Card limits, providing clarity on different aspects and helping you optimize your card usage.

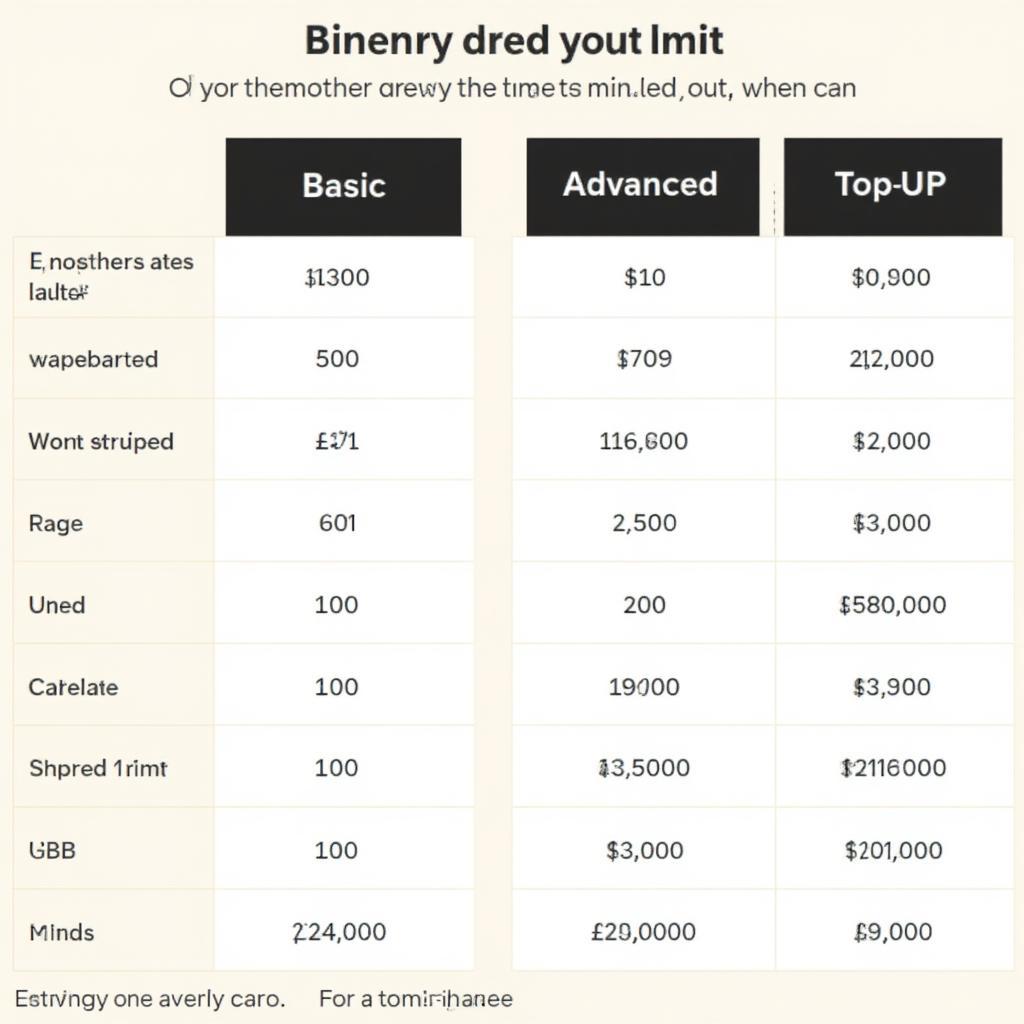

Decoding Binance Card Limits: Spending, Withdrawal, and Top-Up

Binance Card functions like a traditional debit card but draws funds from your Binance crypto wallet. It offers a convenient way to bridge the gap between crypto and everyday spending. However, just like any financial instrument, it comes with certain limitations. These limits are designed to ensure security and comply with regulatory requirements. Broadly, Binance Card limits fall into three main categories: spending limits, withdrawal limits, and top-up limits.

Spending Limits: How Much Can You Spend with Your Binance Card?

Your daily spending limit dictates the maximum amount you can spend using your Binance Card in a 24-hour period. This limit is influenced by your card level, which is determined by your Binance account verification status. Higher verification levels generally unlock higher spending limits. For instance, a basic verified account might have a lower daily spending limit compared to an account with advanced verification. Furthermore, individual merchants may impose their own transaction limits, which could be lower than your Binance Card limit.

Withdrawal Limits: Cashing Out with Your Binance Card

ATM withdrawal limits determine how much cash you can withdraw from an ATM using your Binance Card. These limits are also subject to your card level and verification status. Similar to spending limits, higher verification often translates to higher withdrawal limits. Remember, ATM operators may also have their own withdrawal limits, independent of your Binance Card. It’s crucial to be aware of both to avoid any surprises. Additionally, Binance may charge a fee for ATM withdrawals, which can vary depending on your location and the amount withdrawn.

Top-Up Limits: Funding Your Binance Card

Top-up limits govern the maximum amount you can load onto your Binance Card within a specific timeframe. These limits, like spending and withdrawal limits, are tied to your card level and verification status. Efficiently managing your top-ups is vital to ensure you have sufficient funds available for your spending needs. Keep in mind that topping up your card may involve transaction fees depending on the chosen cryptocurrency and network.

Binance Card Levels and Their Corresponding Limits

Binance employs a tiered system for card levels, directly impacting the applicable limits. Understanding these levels is essential to maximize your card usage.

Basic Verification: Entry-Level Limits

The basic verification level, often the starting point for new users, comes with the lowest set of limits. This level typically requires minimal personal information and identity verification. While sufficient for basic usage, users with higher spending and withdrawal needs might find these limits restrictive.

Advanced Verification: Unlocking Higher Limits

Advanced verification involves submitting additional documentation and undergoing a more thorough identity check. This unlocks higher spending, withdrawal, and top-up limits, providing more flexibility for users.

Navigating Binance Card Fees

While Binance Card offers a convenient spending solution, it’s important to be aware of associated fees.

Transaction Fees: Understanding the Costs

Binance may charge a transaction fee for each purchase made with your Binance Card. This fee is usually a small percentage of the transaction amount and can vary depending on the currency used. Staying informed about these fees helps you budget effectively.

Withdrawal Fees: Costs of Cashing Out

ATM withdrawals usually incur a fee, which can vary based on your location and the amount withdrawn. It’s advisable to check the current fee schedule before making a withdrawal.

Tips for Managing Your Binance Card Limits

Effectively managing your Binance Card limits ensures a smooth spending experience.

- Verify Your Account: Upgrading to a higher verification level increases your limits.

- Plan Your Spending: Be mindful of your daily spending limit to avoid exceeding it.

- Monitor Your Transactions: Regularly check your transaction history to track your spending and available balance.

- Contact Binance Support: If you encounter any issues or have questions regarding your limits, reach out to Binance customer support for assistance.

Binance Card Limits and Security: A Balancing Act

Binance Card limits play a vital role in safeguarding your funds. By limiting transaction amounts, Binance minimizes potential losses in case of unauthorized access or card theft. These limits, combined with other security measures like two-factor authentication, contribute to a secure platform for managing and spending your crypto.

Fraud Prevention and Security Measures

Binance employs various security measures to protect users from fraud and unauthorized activity. These include real-time transaction monitoring, fraud detection algorithms, and the ability to freeze your card instantly if suspicious activity is detected.

Maximizing Your Binance Card: Beyond the Limits

While understanding limits is crucial, optimizing your Binance Card usage extends beyond just knowing the numbers. It involves strategically managing your crypto funds, taking advantage of cashback rewards programs, and staying informed about any updates or changes to the card’s features and policies.

Binance Card: The Future of Spending?

Binance Card represents a significant step towards mainstream crypto adoption. As cryptocurrencies continue to gain traction, solutions like Binance Card bridge the gap between the digital and physical worlds, making crypto spending more accessible and convenient.

“Binance Card empowers users to seamlessly integrate crypto into their daily lives,” says Maria Rodriguez, a Senior Financial Analyst at Global Fintech Solutions. “Understanding the card’s limits is key to maximizing its potential.”

Conclusion: Empowering Your Spending with Binance Card Limits

Understanding Binance Card limits is paramount for a seamless and efficient spending experience. By knowing the different types of limits, their impact on your spending capacity, and how to manage them effectively, you can unlock the full potential of your Binance Card. Stay informed about updates to these limits and leverage the resources provided by Binance to navigate your crypto spending journey.

Frequently Asked Questions (FAQ)

- What is the daily spending limit on a Binance Card? The daily spending limit varies based on your card level and verification status.

- How can I increase my Binance Card limit? You can increase your limit by upgrading your Binance account verification level.

- Are there fees associated with using the Binance Card? Yes, there might be transaction and withdrawal fees depending on your location and the currency used.

- What happens if I exceed my daily spending limit? Your transaction will be declined.

- Can I use my Binance Card internationally? Yes, Binance Card is accepted at millions of merchants worldwide.

- How do I check my current Binance Card limits? You can check your limits in your Binance account settings.

- What should I do if my Binance Card is lost or stolen? Immediately contact Binance support to freeze your card.

- How long does it take to top up my Binance Card? Top-up times can vary depending on the cryptocurrency and network used.

- Where can I find the latest information on Binance Card fees and limits? The most up-to-date information can be found on the official Binance website.