Binance Leveraged Tokens List: A Comprehensive Guide for Traders

Binance leveraged tokens have become a popular, albeit complex, instrument in the crypto trading world. Understanding how to navigate the Binance leveraged tokens list is crucial for any trader looking to amplify their potential gains, or losses, in the volatile cryptocurrency market. This guide delves deep into what these tokens are, how they work, and the risks and benefits they present, along with strategies for effectively using them. We will also explore the often overlooked list of tokens available, which can significantly impact trading decisions.

Understanding Binance Leveraged Tokens

Binance leveraged tokens are designed to give traders leveraged exposure to an underlying asset without the need to manage margin, collateral, or liquidation prices. They are not, however, without their nuances.

What Exactly Are They?

These are ERC20 tokens issued by Binance, each representing a basket of perpetual contract positions. Each leveraged token represents a different leverage multiple (e.g., 3x, -1x). They rebalance their positions regularly to maintain their target leverage. This process is designed to allow users to potentially profit from market movements without active management. It’s important to understand that a Binance leveraged tokens list is diverse and contains tokens tied to various cryptocurrencies and market conditions.

How Do They Work?

When you purchase a leveraged token, you’re essentially buying a share of an underlying derivative position. For example, a 3x BTCUP token increases exposure to Bitcoin by a factor of 3. If Bitcoin rises by 1%, the 3x BTCUP token should rise approximately by 3% (and vice versa). The “UP” and “DOWN” indicate which direction the leverage is. The rebalancing mechanism is where the complexity lies, with the tokens automatically adjusting their position to minimize slippage. However, this also means that in highly volatile periods, you can lose value due to the process.

Key Features

- Leveraged Exposure: Traders can amplify both gains and losses using these tokens.

- No Collateral or Margin Requirements: They eliminate the complexity associated with margin trading.

- Automatic Rebalancing: Tokens automatically adjust their positions, but this can lead to issues during periods of extreme volatility

- Multiple Options: The Binance leveraged tokens list offers various exposure levels (typically 3x and -1x) and underlying assets.

- Ease of Use: The simplicity in trading leveraged tokens makes them accessible to less experienced users, though it also carries more risks for those without sufficient knowledge.

“Leveraged tokens are powerful instruments, but they’re not for everyone. You need a solid understanding of how they work to avoid being caught off guard, especially in turbulent market conditions.” – Dr. Evelyn Reed, Senior Financial Analyst at Global Markets Insights.

Navigating the Binance Leveraged Tokens List

Understanding the Binance leveraged tokens list is the first step towards effectively utilizing these tools. Here’s how to make sense of the available options.

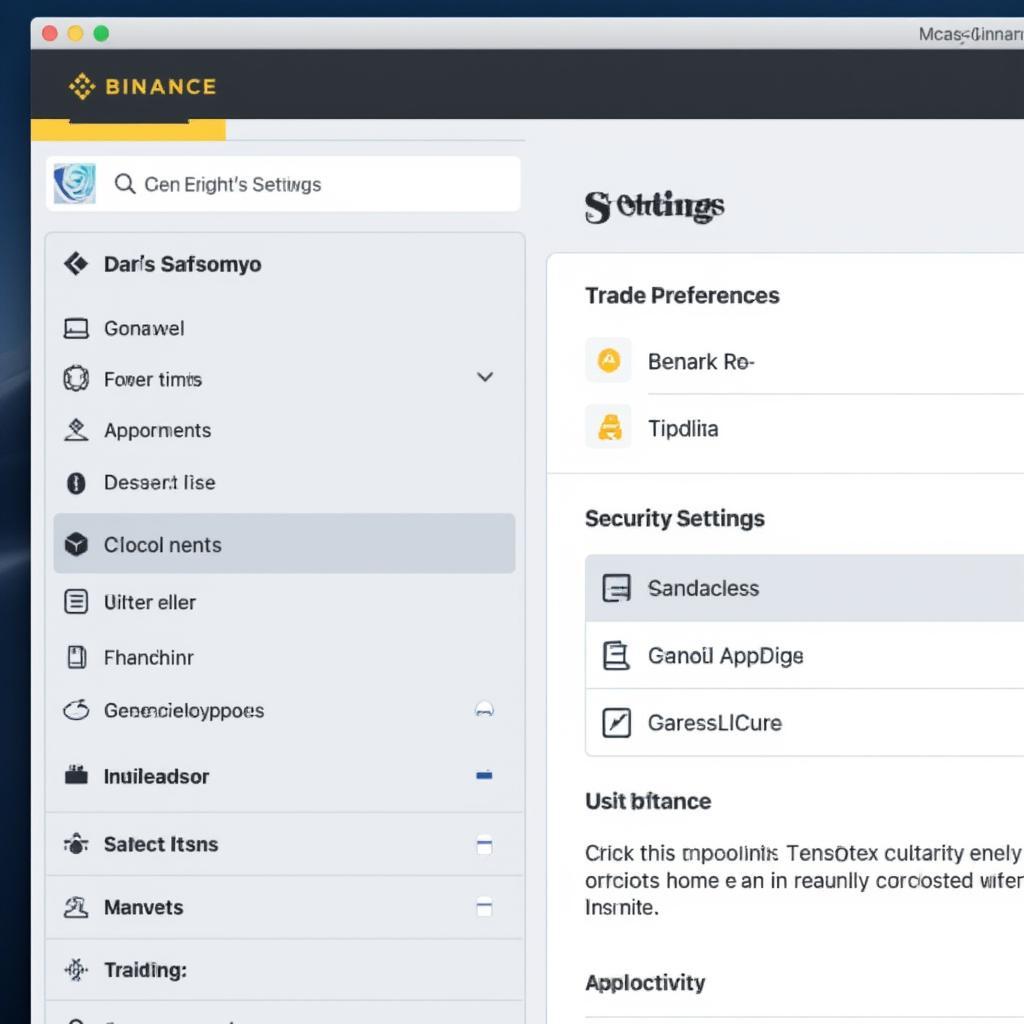

How to Find the List

The complete list is available on the Binance platform, typically under the “Derivatives” or “Leveraged Tokens” sections. It’s a good idea to familiarize yourself with the navigation to quickly access this list. Remember that the list can change over time, with new tokens added and delisted, so staying up-to-date is key.

Understanding Token Tickers

Each token has a unique ticker symbol. For example:

- BTCUP: This represents a 3x leveraged position on Bitcoin with the anticipation of a price increase.

- BTCDOWN: This represents a 3x leveraged position on Bitcoin with the anticipation of a price decrease.

- ETHUP & ETHDOWN: These are corresponding tokens for Ethereum

- There are many more related to various assets on the exchange.

- Pay close attention to these tickers as they will give you a clear understanding of the position they represent.

Key Metrics to Consider

When exploring the Binance leveraged tokens list, several metrics deserve careful consideration:

- Daily Performance: This shows how the token performed on the previous day.

- Net Asset Value (NAV): This reflects the actual value of the underlying assets of the token.

- Historical Data: Examine past performance to understand how each token has reacted to different market conditions.

- Volume: Higher volume indicates greater liquidity, making it easier to buy and sell without significant price slippage.

- Underlying Asset: Always be aware of which asset the token is tied to.

- Leverage Factor: Know the leverage factor associated with the token before trading.

- Rebalancing Mechanism: Learn how the rebalancing happens. Usually, Binance’s official websites will have the information.

Strategies for Using Leveraged Tokens Effectively

Leveraged tokens are not for passive investments; a sound strategy is crucial for success.

Risk Management is Key

* **Understand the Risks:** Leveraged tokens are complex. You should not risk capital you cannot afford to lose, as they can amplify losses as well as gains.

* **Diversification:** Don’t put all your trading capital in a single leveraged token.

* **Stop-Loss Orders:** Always use stop-loss orders to mitigate potential losses.

* **Smaller Positions:** Start with smaller positions until you understand the impact of your trades.Ideal Scenarios for Using Leveraged Tokens

* **Strong Market Trends:** Leveraged tokens can be effective when you expect a strong, sustained move in a specific direction.

* **Short-Term Trades:** They are usually better suited for shorter time horizons, not long term investments, due to the effects of decay over time.

* **Hedging:** You can use “down” tokens to hedge against positions in the same asset.

* **Leverage without Margin Trading:** They are an alternative for those who do not want to directly margin trade.Scenarios to Avoid

* **Volatile Markets:** Avoid using them when markets are moving rapidly in both directions, as you can be negatively impacted by the rebalancing mechanisms.

* **Uncertain Market Conditions:** Wait for the market to stabilize before making trades.

* **Long-Term Investments:** They are not suited for long-term holdings because of their volatility and value decay.“Success with leveraged tokens comes from understanding market dynamics and managing risk effectively, not just by chasing quick gains.” – Ethan Hayes, Cryptocurrency Trading Strategist at Capital Flow Strategies.

Risks Associated with Leveraged Tokens

While they offer the potential for profit, understanding the drawbacks is essential to make informed trading decisions using the Binance leveraged tokens list.

Volatility and Decay

* **Price Decay:** The rebalancing process can lead to the erosion of the token’s value over time, especially in choppy markets.

* **Amplified Losses:** Just as gains are amplified, so are losses.

* **Slippage:** This can occur during the rebalancing process and can reduce the value of your token, as the token changes its position.Limited Liquidity

* **Not Always Liquid:** Not all leveraged tokens have the same liquidity. This is particularly important to be aware of as you go down the *Binance Leveraged Tokens List*.

* **Difficulty Selling:** Low liquidity can make it hard to exit positions without incurring losses.

* **Slippage:** Low liquidity increases slippage issuesOther Risks

* **Complexities:** Leveraged tokens are complex products; it's crucial to understand how the rebalancing process impacts value.

* **Platform Risk:** There is a risk associated with using any centralized platform like Binance. There is also a chance that the exchange may delist specific tokens that you may be holding.

* **Regulatory Risk:** Regulations around leveraged products are constantly evolving and may change without notice, which can affect your positions.

Practical Example of Using a Leveraged Token

To illustrate, consider you believe Bitcoin’s price is going to rise soon. You could purchase BTCUP, a 3x leveraged token tied to Bitcoin. If Bitcoin increases by 1%, BTCUP should increase roughly 3%, giving you higher return. Conversely, if Bitcoin drops by 1%, BTCUP could drop by 3%. This demonstrates the potential for both high returns and losses inherent with the tokens on the Binance leveraged tokens list.

Steps to Trading a Leveraged Token

- Access Binance: Log into your Binance account.

- Navigate to Leveraged Tokens: Find the Leveraged Tokens section under “Derivatives”.

- Choose a Token: Review the Binance leveraged tokens list and select the token you are interested in.

- Analyze Key Metrics: Look at its performance, volume, and underlying asset.

- Place an Order: Decide whether to place a buy or sell order.

- Set Stop-Loss: Implement stop-loss to minimize any potential losses.

- Monitor the Market: Keep track of how the token is doing.

Conclusion

Leveraged tokens offer a way to amplify market exposure without margin trading, yet come with a range of risks that every trader must understand. The Binance leveraged tokens list is expansive, so a thorough review of available options is essential. Remember that knowledge, risk management, and a clear trading strategy are your greatest assets when navigating the complex landscape of leveraged tokens. These are not “get rich quick schemes”, and should be used carefully and methodically.

FAQ

What are Binance leveraged tokens?

Binance leveraged tokens are ERC20 tokens that provide leveraged exposure to an underlying asset without requiring margin management or liquidation risks. They are a way to amplify your exposure but are not without the risk of loss.

How does the rebalancing mechanism work?

These tokens automatically rebalance their positions daily or more frequently to maintain a target leverage ratio. This helps mitigate risks associated with margin trading but can sometimes lead to value decay, especially in volatile markets.

Where can I find the Binance leveraged tokens list?

The list can be found on the Binance exchange, typically under the “Derivatives” or “Leveraged Tokens” section. It’s essential to check this list regularly to understand new tokens and changes.

What are the benefits of using these tokens?

The main benefits are the ease of use, the ability to gain leveraged exposure without margin trading and to potentially profit from both up and down markets. However, they should not be viewed as easy to use without risk.

What are the main risks associated with them?

The primary risks include the potential for amplified losses, price decay, volatility, slippage, and liquidity issues, which is why understanding risk management is paramount.

How should I decide which leveraged token to trade from the Binance leveraged tokens list?

Choose a token that matches your view of the market direction, considering your risk tolerance and analysis of the token’s performance, volume, and underlying asset. Do not trade a token you do not understand.

Are leveraged tokens suitable for long-term investment?

No, they are generally better suited for short-term trades. The rebalancing mechanism and volatility often lead to price decay over time, making them less suitable for long-term holdings.

Can I use leveraged tokens for hedging?

Yes, you can use “down” tokens to hedge against your positions of the same underlying asset, but you still need to be aware of slippage, and decay. This is not a perfect system, but could potentially alleviate some losses in some scenarios.