Car Insurance for Old Vehicles: A Comprehensive Guide

Owning a classic car is a rewarding experience, but finding the right Car Insurance For Old Vehicles can be challenging. This guide explores the nuances of insuring your prized possession, ensuring you have the right coverage without breaking the bank.

Understanding Classic Car Insurance

Unlike standard car insurance, classic car insurance recognizes the unique nature of these vehicles. It takes into account the limited mileage, meticulous maintenance, and secure storage often associated with classic cars, often resulting in lower premiums than standard policies. The value of a classic car is not determined solely by its age, but by its condition, rarity, and historical significance.

Agreed Value vs. Stated Value

One of the most crucial aspects of car insurance for old vehicles is understanding the difference between “agreed value” and “stated value.” Agreed value policies establish a fixed sum insured, agreed upon by you and the insurer, which represents the car’s insured value in case of a total loss. This eliminates the hassle of haggling over the car’s worth after an incident. Conversely, stated value policies set a maximum payout limit, but the insurer might still offer a lower settlement based on their own valuation. For classic cars, agreed value is almost always the preferred option.

Specialized Coverage Options

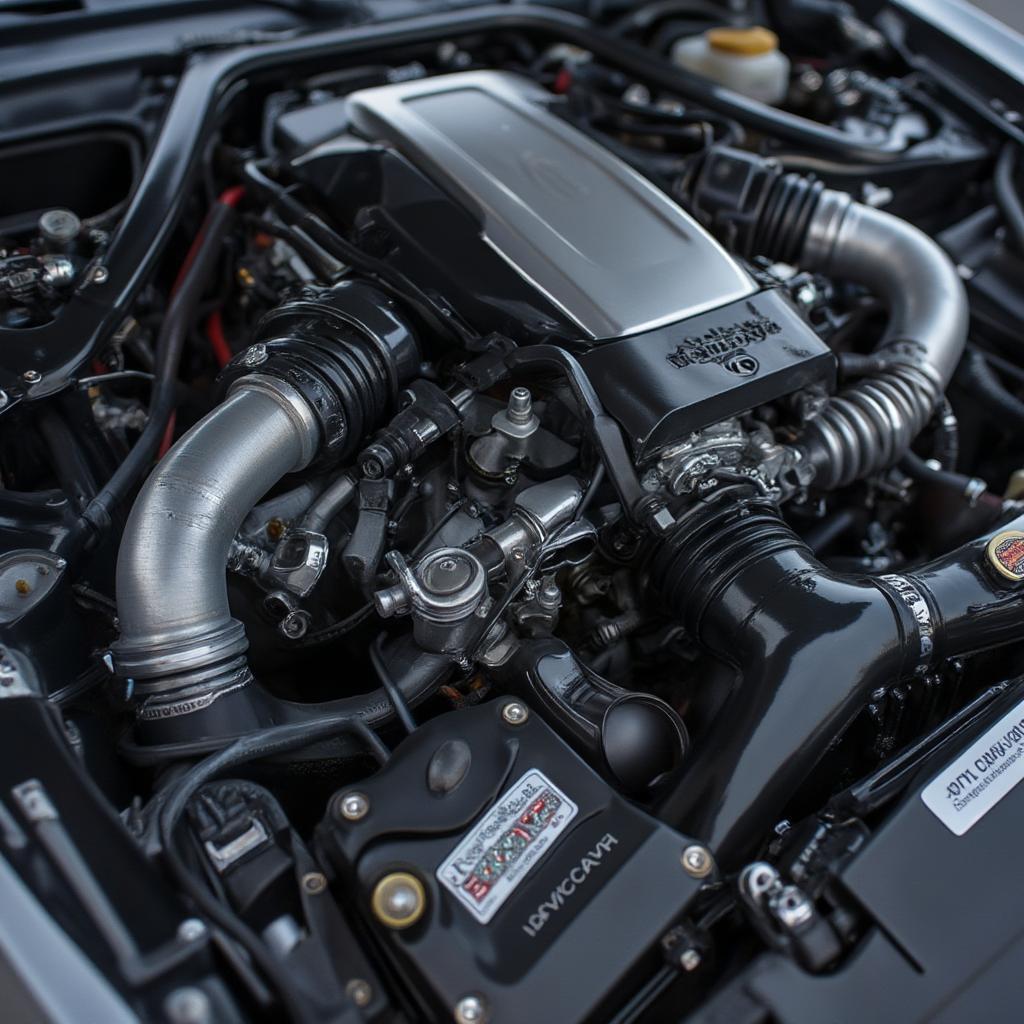

Classic car insurance often offers specialized coverage tailored to the needs of vintage vehicle owners. For example, “parts and accessories” coverage protects valuable aftermarket additions or original components not covered by standard policies. “Spare parts” coverage safeguards your collection of rare parts stored separately. “Restoration coverage” provides protection during restoration projects, addressing potential risks unique to this process.

Factors Affecting Classic Car Insurance Premiums

Several factors influence the cost of car insurance for old vehicles. The car’s make, model, and year of manufacture play a significant role. Rarer models are generally more expensive to insure. Your driving history, including any accidents or violations, will also impact your premium. Where you store your classic car, whether in a secure garage or not, is another important factor. Finally, the intended use of the vehicle, whether for occasional shows or regular driving, will also affect your insurance rate.

Mileage Restrictions and Usage

Most classic car insurance policies come with mileage restrictions. This is because limited mileage reduces the risk of accidents. Be sure to discuss your intended usage with your insurer to ensure you select a policy that aligns with your driving habits. If you plan on driving your classic car regularly, you may need a policy with higher mileage allowance, which might result in a higher premium.

Finding the Right Classic Car Insurance Provider

Choosing the right classic car insurance provider requires careful research. Don’t simply opt for the cheapest option. Look for insurers specializing in classic car insurance, as they have the expertise and understanding of the unique needs of these vehicles. Read online reviews and compare quotes from different providers.

Questions to Ask Potential Insurers

- Do you offer agreed value coverage?

- What are your mileage restrictions?

- What types of specialized coverage do you offer?

- Do you have experience insuring [your classic car’s make and model]?

- What are your claims procedures?

Tips for Lowering Your Premium

- Join a classic car club: Many insurers offer discounts to members of recognized classic car clubs.

- Install anti-theft devices: Adding security features can lower your premium.

- Maintain a clean driving record: A good driving history demonstrates lower risk.

- Store your car securely: Secure storage, such as a locked garage, reduces the risk of theft or damage.

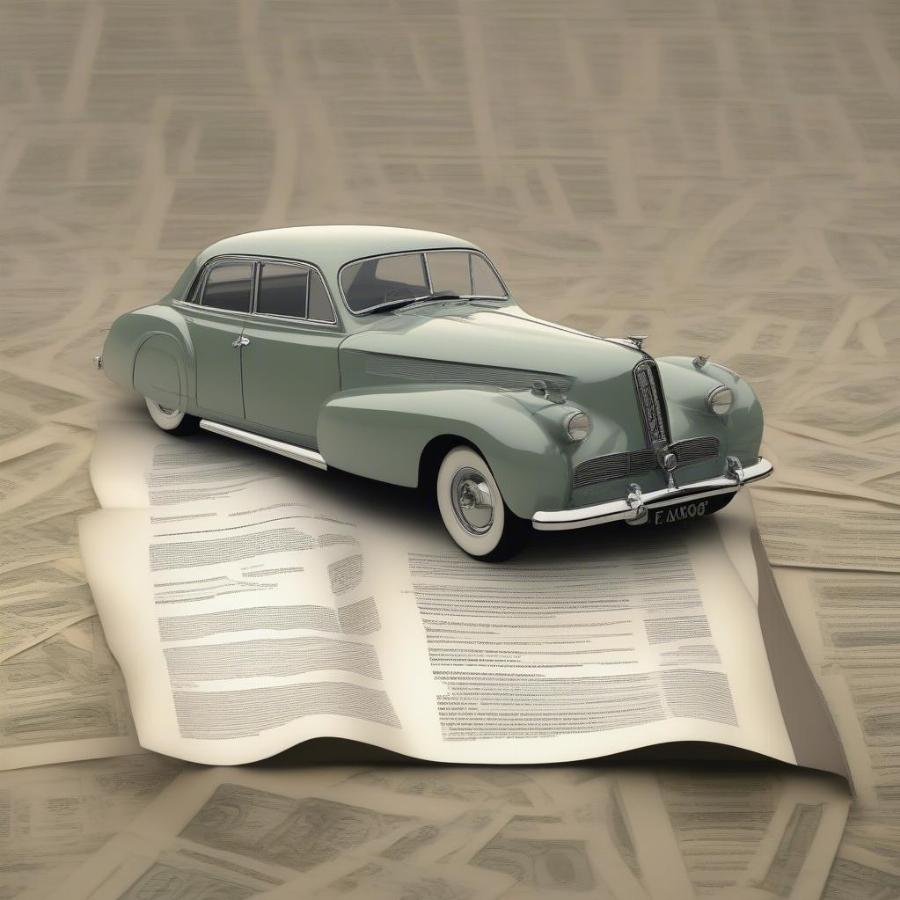

Protecting Your Investment

Car insurance for old vehicles is not just about fulfilling a legal requirement; it’s about protecting your investment. Classic cars are often more than just vehicles; they are cherished possessions with sentimental value. Choosing the right insurance ensures peace of mind, knowing that your prized possession is adequately protected.

“A classic car represents a piece of history,” says renowned classic car appraiser, Amelia Hayes, “and insuring it correctly is about preserving that history for future generations.”

Conclusion

Finding the right car insurance for old vehicles can be a detailed process, but it’s an essential one. By understanding the specific requirements of classic car insurance, comparing policies, and asking the right questions, you can ensure your cherished vehicle is adequately protected. Don’t hesitate to invest the time necessary to find the perfect coverage for your classic car, safeguarding it for years to come.

FAQ

- What is the difference between classic car insurance and regular car insurance? Classic car insurance caters to the specific needs of vintage vehicles, often offering agreed value coverage and specialized options.

- Is classic car insurance more expensive than regular car insurance? Not necessarily. Due to limited mileage and secure storage, premiums can be lower.

- Do I need specialized coverage for my classic car? It depends on your car’s value, modifications, and intended use. Discuss your needs with a specialist.

- How can I find a reputable classic car insurance provider? Research insurers specializing in classic cars, compare quotes, and read online reviews.

- What are some ways to lower my classic car insurance premium? Joining a car club, installing anti-theft devices, and maintaining a clean driving record can help.

- What is agreed value in classic car insurance? Agreed value is a pre-determined sum insured, agreed upon by you and the insurer, representing the car’s value in case of a total loss.

- What are typical mileage restrictions for classic car insurance? Mileage restrictions vary depending on the policy, so discuss your intended usage with your insurer.