Cheap Classic Car Insurance for Young Drivers: A Comprehensive Guide

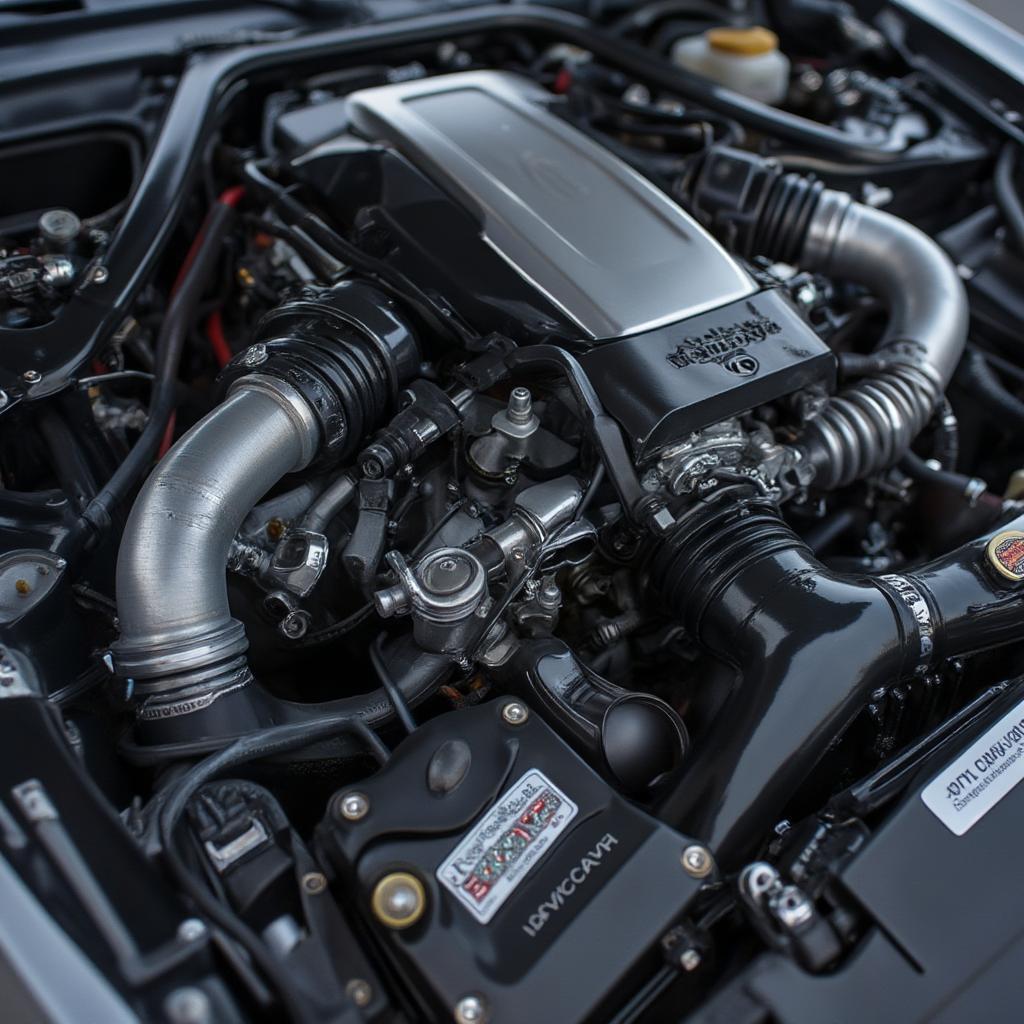

Classic cars represent a unique blend of history, engineering, and style. For young drivers, the allure of owning a piece of automotive history can be incredibly strong. However, one of the biggest hurdles to overcome is securing affordable classic car insurance. This guide delves into the intricacies of finding Cheap Classic Car Insurance For Young Drivers, providing valuable insights and practical tips.

Similar to classic car valuations, insurance premiums can vary significantly based on several factors. Understanding these factors is crucial for young drivers looking to minimize their insurance costs.

Understanding Classic Car Insurance for Young Drivers

Classic car insurance isn’t a one-size-fits-all product. It differs significantly from standard car insurance due to the unique nature of these vehicles. Classic cars are often less frequently driven, stored securely, and maintained meticulously. These factors contribute to a lower risk profile, potentially leading to lower premiums compared to regular vehicles. However, for young drivers, perceived inexperience can sometimes inflate insurance costs.

How insurance companies define a “classic car” also plays a role. Generally, vehicles over a certain age (often 20-25 years), with historical significance, limited production numbers, or unique design features qualify. Knowing these criteria can help you determine whether your vehicle qualifies for specialized classic car insurance and the potential savings it offers.

Finding Cheap Classic Car Insurance: Tips and Strategies

Securing affordable classic car insurance as a young driver requires a proactive approach. Here are some proven strategies to help you find the best deal:

- Limited Mileage Policies: These policies offer lower premiums in exchange for restricting your annual mileage. This is ideal for classic cars used primarily for weekend drives or special occasions. By agreeing to drive less, you demonstrate lower risk and qualify for reduced rates.

- Agreed Value Policies: Unlike standard insurance, which depreciates your car’s value over time, agreed value policies establish a fixed insured amount based on the car’s appraised value. This provides better protection in the event of a total loss and offers peace of mind knowing you’ll receive a fair payout.

- Join a Classic Car Club: Many insurers offer discounts to members of recognized classic car clubs. This not only saves you money but also connects you with a community of fellow enthusiasts. Clubs provide a valuable platform for sharing knowledge, resources, and experiences.

- Maintain a Clean Driving Record: A spotless driving history demonstrates responsibility and significantly reduces insurance premiums. Avoiding accidents and traffic violations can dramatically impact your insurance costs over time.

- Security and Storage: Storing your classic car in a secure garage or facility can lower insurance rates. Insurers recognize that secure storage mitigates the risk of theft and damage. Investing in anti-theft devices can further enhance your savings.

Comparing Classic Car Insurance Quotes

Don’t settle for the first quote you receive. Comparing quotes from multiple insurers is essential for finding the best deal. Utilize online comparison tools and contact insurers directly to get a comprehensive overview of available options. Pay attention to coverage details, deductibles, and any additional benefits offered.

“Getting multiple quotes is crucial,” advises John Peterson, a classic car insurance specialist at Heritage Auto Insurance. “Don’t assume all policies are equal. Compare coverage carefully and choose the option that best suits your needs and budget.”

Factors Affecting Classic Car Insurance Costs

Several factors influence classic car insurance premiums for young drivers:

- Age: Younger drivers are generally considered higher risk, resulting in higher premiums. Gaining driving experience and maintaining a clean record can help lower costs over time.

- Vehicle Type and Value: Rare and expensive classic cars command higher premiums due to their increased replacement cost. Common, less valuable models tend to be more affordable to insure.

- Location: Insurance costs vary based on geographic location. Areas with higher rates of theft or accidents typically have higher premiums. Rural areas with lower traffic density might offer more competitive rates.

Classic Car Insurance: Beyond the Basics

Beyond the standard coverage, consider these additional options:

- Agreed Value coverage: This protects your investment by ensuring a pre-agreed payout in case of a total loss, regardless of market fluctuations.

- Roadside Assistance: Specialized roadside assistance caters to the unique needs of classic cars, offering towing services with appropriate equipment to avoid further damage.

- Spare Parts Coverage: This valuable option covers the cost of replacing rare or expensive parts, which can be challenging to find for classic cars.

The Future of Classic Car Insurance for Young Drivers

As the classic car market evolves, so too will insurance options. With the rise of technology, telematics and usage-based insurance could become more prevalent, potentially offering personalized premiums based on individual driving habits.

“The future of classic car insurance is likely to be more data-driven,” says Maria Sanchez, an automotive industry analyst at FutureCar Insights. “This could benefit responsible young drivers who can demonstrate safe driving practices through telematics data.”

Conclusion

Finding cheap classic car insurance for young drivers requires research, diligence, and a strategic approach. By understanding the factors that influence premiums and implementing the tips outlined in this guide, you can navigate the insurance landscape effectively and enjoy the thrill of owning a classic car without breaking the bank. Start comparing quotes today and embark on your classic car journey with confidence.

FAQ: Cheap Classic Car Insurance for Young Drivers

- What is the average cost of classic car insurance for young drivers? The cost varies significantly based on factors like age, car model, and location, making it crucial to obtain individualized quotes.

- Do I need specialized classic car insurance? Yes, regular car insurance policies often don’t adequately cover the unique needs of classic cars.

- How can I lower my classic car insurance premiums? Consider limited mileage policies, join a classic car club, maintain a clean driving record, and ensure secure storage.

- What is an agreed value policy? This policy establishes a fixed insured amount for your car, protecting you from depreciation in case of a total loss.

- Where can I find classic car insurance quotes? Utilize online comparison tools and contact insurers specializing in classic car coverage.

- What additional coverage options should I consider? Look into roadside assistance specifically for classic cars and spare parts coverage for rare components.

- How is technology impacting classic car insurance? Telematics and usage-based insurance could offer personalized premiums based on individual driving behavior in the future.