Cheapest Car Insurance for Old Cars: A Classic Car Lover’s Guide

Finding the Cheapest Car Insurance For Old Cars can feel like searching for a rare vintage part. But with the right knowledge and a bit of patience, you can protect your classic beauty without breaking the bank. This guide will navigate you through the intricacies of insuring your cherished vehicle, offering tips and insights to help you secure the best possible coverage at the most affordable price.

Understanding Classic Car Insurance

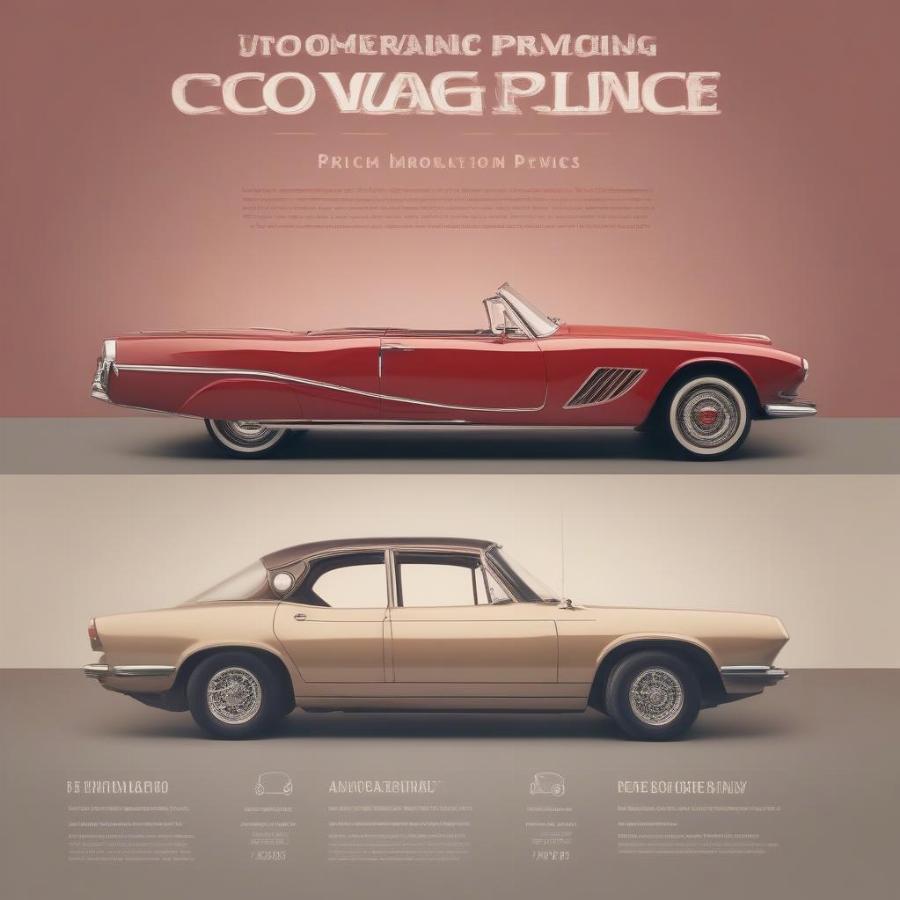

Classic car insurance isn’t a one-size-fits-all solution. It’s tailored to the unique needs of vintage and classic vehicles, recognizing their lower mileage, limited use, and inherent value as collector’s items. Unlike standard auto insurance, classic car policies often offer agreed value coverage, meaning you and the insurer agree on your car’s worth upfront. This eliminates the depreciation factor that comes into play with regular car insurance, ensuring you receive the full agreed-upon amount in the event of a total loss. Knowing the difference between standard and classic car insurance is crucial for finding the cheapest car insurance for old cars.

Why is Classic Car Insurance Different?

Standard car insurance policies are designed for daily drivers, factoring in risks associated with frequent use and higher mileage. Classic cars, often driven sparingly and kept in pristine condition, represent a different risk profile. This is why specialized classic car insurance exists, offering tailored coverage options and potentially lower premiums than standard policies for eligible vehicles.

What qualifies as a “classic car” for insurance purposes? Generally, vehicles over 25 years old, kept in excellent condition, and used primarily for exhibitions, club events, and occasional pleasure drives qualify. However, some insurers may have different criteria, so it’s crucial to check their specific requirements.

Finding the Cheapest Car Insurance for Old Cars

Securing the cheapest car insurance for old cars requires research and comparison shopping. Don’t settle for the first quote you receive. Instead, gather quotes from multiple specialized classic car insurers. Here’s how:

- Research Specialized Insurers: Start by researching insurers known for their expertise in classic car coverage. Look for companies that understand the unique needs of vintage vehicle owners and offer tailored policies.

- Get Multiple Quotes: Request quotes from several insurers, providing accurate details about your car, its usage, and your driving history. This allows you to compare coverage options and pricing side-by-side.

- Consider Agreed Value: Opt for agreed value coverage to protect your car’s true worth. This is particularly important for classic cars, whose market value can fluctuate significantly.

- Bundle Policies: If you have other insurance needs, such as homeowner’s or life insurance, consider bundling them with the same insurer. Many companies offer discounts for bundled policies.

- Join a Car Club: Membership in a recognized classic car club can often unlock discounts on insurance premiums. Insurers see club members as responsible owners who take pride in maintaining their vehicles.

Factors Affecting Classic Car Insurance Costs

Several factors influence classic car insurance premiums. Understanding these can help you manage costs. They include:

- Vehicle Value: The higher your car’s agreed value, the higher the premium will be.

- Usage: Limited usage for pleasure drives and exhibitions typically results in lower premiums compared to daily driving.

- Storage: Secure storage in a garage can lower your risk profile and potentially reduce premiums.

- Driving History: A clean driving record demonstrates responsible driving habits and can lead to lower insurance costs.

- Deductible: Choosing a higher deductible can lower your premium, but ensure it’s an amount you can comfortably afford in case of a claim.

Protecting Your Investment: Tips for Lower Premiums

Beyond the basics, there are several proactive steps you can take to potentially lower your classic car insurance premiums:

- Install Security Features: Adding anti-theft devices, such as alarms or tracking systems, can demonstrate your commitment to protecting your car and potentially qualify you for discounts.

- Take a Defensive Driving Course: Completing a defensive driving course can show insurers you are a responsible driver and potentially lead to premium reductions.

- Maintain Your Car Meticulously: Keeping your classic car in top condition not only preserves its value but also reflects well on your ownership and can positively influence your insurance rates.

“Regular maintenance and secure storage are key,” says classic car expert, Amelia Hartwell, of Vintage Auto Appraisals. “These factors not only protect your investment but also demonstrate responsible ownership to insurers, potentially leading to lower premiums.”

Common Mistakes to Avoid

When searching for the cheapest car insurance for old cars, avoid these common pitfalls:

- Choosing the Cheapest Policy Without Considering Coverage: The lowest price doesn’t always mean the best value. Ensure the policy offers adequate coverage for your specific needs.

- Neglecting to Compare Quotes: Shopping around and comparing quotes from multiple insurers is essential for finding the best deal.

- Not Disclosing Modifications: Be upfront about any modifications made to your car. Failing to disclose them could invalidate your coverage.

“Don’t underestimate the value of agreed value coverage,” adds Ms. Hartwell. “It ensures you receive the full agreed-upon amount in the event of a total loss, protecting your investment and providing peace of mind.”

Conclusion

Finding the cheapest car insurance for old cars requires careful consideration of your classic car’s unique needs. By understanding the factors that influence premiums and following the tips outlined in this guide, you can secure the best possible coverage at an affordable price, ensuring your cherished vehicle is protected for years to come. Remember to compare quotes, consider agreed value coverage, and research specialized insurers to find the perfect policy for your classic beauty.

FAQ

- What is the average cost of classic car insurance? The cost varies depending on several factors, including the car’s value, usage, and your driving history.

- Do I need specialized classic car insurance? If your car is primarily used for exhibitions and occasional pleasure drives, specialized classic car insurance is often a better choice than standard auto insurance.

- How can I lower my classic car insurance premiums? Joining a car club, installing security features, and maintaining a clean driving record can help lower your premiums.

- What is agreed value coverage? Agreed value coverage means you and the insurer agree on your car’s value upfront, ensuring you receive the full agreed-upon amount in the event of a total loss.

- What are some reputable classic car insurance companies? Research specialized insurers known for their expertise in classic car coverage, such as Hagerty, Grundy, and American Collectors Insurance.

- Do I need to disclose modifications to my classic car? Yes, it’s crucial to disclose any modifications to your insurer to ensure your coverage remains valid.

- How often should I review my classic car insurance policy? Review your policy annually or whenever there are significant changes in your car’s usage or value.