Coin Burn Meaning: Understanding Token Destruction and its Impact

Coin burning, a concept that might sound destructive, is actually a strategic move in the cryptocurrency world. At its core, Coin Burn Meaning refers to the permanent removal of a specific number of cryptocurrency tokens from the total circulating supply. This isn’t about physically destroying coins; rather, it involves sending them to a designated wallet address – often called a “burn address” – from which they can never be retrieved or used. Let’s delve deeper into why this happens, how it works, and what implications it carries.

Why Do Cryptocurrencies Burn Tokens?

The practice of coin burning isn’t random; it’s a deliberate action often taken for various strategic reasons.

- Increasing Scarcity and Value: One of the primary motives behind coin burns is to reduce the total supply of a cryptocurrency. Similar to how a limited edition item becomes more valuable, reducing the available coins in circulation is intended to increase the demand and thus drive up the price per coin. The basic economics of supply and demand come into play here. By making the tokens scarcer, they theoretically become more valuable. This can be seen as a method to incentivize holders.

- Stabilizing Token Price: Volatility is a prominent characteristic of the cryptocurrency market. Coin burns can be used as a mechanism to stabilize the price of a token, especially during periods of price drops or fluctuations. By strategically removing a number of tokens, projects may attempt to create a sense of stability by limiting supply.

- Deflationary Measures: Unlike traditional fiat currencies, which are often subject to inflation, some cryptocurrencies aim to be deflationary. Coin burning contributes to this deflationary model by gradually decreasing the total supply over time. This can make the cryptocurrency more appealing to holders who are looking for long-term value growth as their holdings become more valuable due to reduced overall supply.

- Rewarding Token Holders: Some projects implement coin burning as a way to reward long-term investors. For example, a percentage of transaction fees might be used to burn tokens. This means that as the network usage grows, the coin burning rate increases, further reducing the circulating supply and potentially benefitting holders.

- Correcting Token Supply Issues: In some cases, coin burns can also be used to correct errors or issues with token supply. For instance, if more tokens were created than intended, a burn can be used to bring the circulating supply back into alignment with the plan.

- Community Engagement: Coin burning events can generate interest, excitement, and boost community morale around a project. These events are sometimes broadcast, involving and engaging the token holders, thus increasing the overall feeling of involvement with the project.

How Does Coin Burning Actually Work?

The mechanics behind coin burning are quite straightforward, yet essential for the functioning of the entire system.

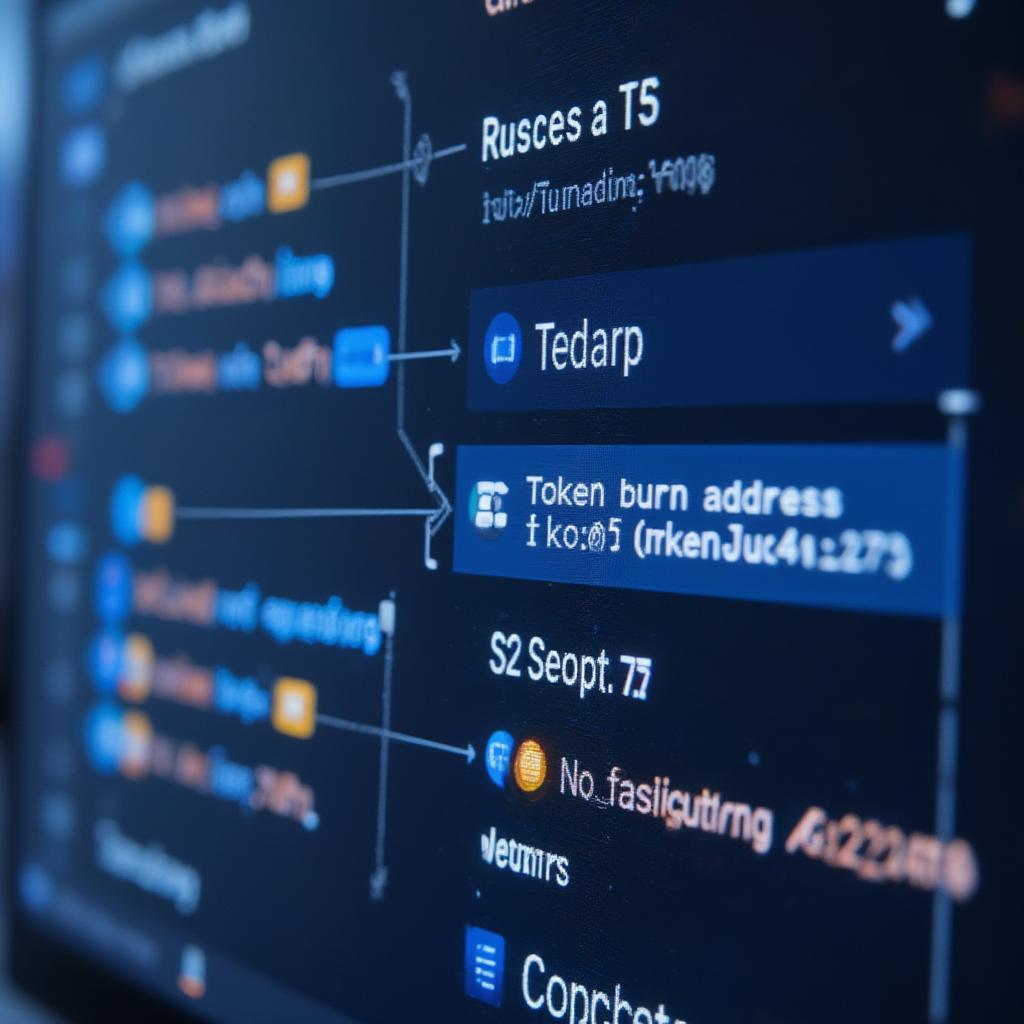

- Designated Burn Address: A burn address is simply a cryptocurrency wallet address for which the private key is unknown or deliberately made inaccessible. This essentially makes the wallet and any tokens sent to it unusable.

- Transfer of Tokens: The cryptocurrency project or organization sends the predetermined number of tokens to this burn address.

- Permanent Loss: Because the private key to the burn address is unknown, there’s no way to move these tokens back into circulation. These burned coins are now permanently and verifiably out of circulation.

- Transparency: Most coin burn events are usually announced and logged on the blockchain for public verification. This transparency is paramount in maintaining trust among the stakeholders of the cryptocurrency project.

Coin Burn Address and Transaction

The Role of Proof-of-Burn

It’s important to note that while most coin burns are pre-planned and executed as explained above, there is a separate mechanism known as Proof-of-Burn (PoB). PoB is a consensus mechanism used in some blockchains. It involves participants burning their cryptocurrency to earn the right to mine or validate new blocks. However, this mechanism is different from standard coin burning and it involves creating a new block while destroying cryptocurrency. While both concepts involve burning coins, they function very differently. Proof of burn can be considered a part of the broader topic but it’s not the essence of it.

Types of Coin Burns

Coin burning isn’t a one-size-fits-all approach. It can take various forms depending on the specific objectives of the project.

- Scheduled Burns: Some projects implement regular, scheduled coin burns. This could be monthly, quarterly, or annually. The aim is to have a predictable and consistent impact on supply.

- Event-Based Burns: These burns are triggered by specific events, such as reaching a milestone or completing a particular goal. They create more flexibility and can react to the market conditions in real-time.

- Transaction Fee Burns: A percentage of transaction fees are used to buy back and burn tokens. This makes the coin burning mechanism directly proportional to the network activity.

- Developer Burns: The project development team can also engage in token burns, often at specific intervals or to honor a promise for community support and value generation.

- Error Correction Burns: As mentioned, these burns are to address errors, like having created too many coins.

Pros and Cons of Coin Burning

Like any tool, coin burning has its advantages and disadvantages. Understanding both is important for a balanced view.

Pros

- Price Appreciation: As mentioned earlier, one of the primary goals of coin burn is to drive up the price of the tokens by creating scarcity.

- Enhanced Token Stability: Coin burning can help create stability, especially when implemented strategically.

- Incentivizes Holding: By reducing the supply, coin burns make the token scarcer, incentivizing holders.

- Increase in Token Value: If the burn leads to increased scarcity and higher demand, holders may experience a rise in their holding’s value.

- Positive Feedback Loop: Transaction fee burning can create a positive feedback loop; as more transactions happen, more tokens are burned, leading to potentially higher prices and more adoption.

- Community Engagement: Coin burn events, when well communicated, can foster community engagement and increase the interest in a project.

Cons

- No Guarantee of Success: While coin burns aim to increase price, there’s no absolute guarantee of that happening. Market sentiment and other external factors can also influence price.

- Manipulation Risks: The mechanism can be abused for market manipulation, and projects might use this to pump the price short term without having sustainable growth.

- Artificial Scarcity: Some critics argue that coin burning creates artificial scarcity, leading to overvaluation that is detached from actual product utility or adoption rates.

- May Alienate Some: If the coin burns are perceived as unfair, it can alienate some community members who feel that they don’t gain any positive outcome out of the process.

- Lost Potential Utility: Burning coins means that those tokens cannot be used for development, funding, or other potential projects.

- Miscommunication: If coin burning events are not clearly explained, it can lead to misunderstandings and distrust amongst the token holders.

“Coin burning should be viewed as one tool in a cryptocurrency project’s toolbox, not a magic bullet,” explains Dr. Eleanor Vance, a blockchain economics expert. “While it can be effective in specific circumstances, it’s crucial to analyze the underlying fundamentals and consider the long-term impact.”

How Does Coin Burning Affect Investors?

For investors, understanding coin burning is essential because it can have a direct impact on their investments.

- Potential for Increased Value: The main benefit for investors is the potential for an increase in value of their holdings if the burn successfully drives up demand for the token.

- Risk of Market Volatility: However, there’s always the risk that the burn might not have the desired effect, and the price could decrease if the markets don’t react as expected.

- Importance of Research: It is important for investors to do proper research, rather than blindly relying on coin burning as a sign of good investment opportunity.

- Impact on Tokenomics: Coin burning can change the tokenomics of a project, therefore it is necessary to understand the full ramifications of such changes.

- Long-Term Vision: Investors need to assess whether coin burning is part of a sustainable long-term strategy or just a short-term attempt to pump the market price.

Real-World Examples of Coin Burning

Several cryptocurrencies have implemented coin burns with varying degrees of success.

- Binance Coin (BNB): Binance, a leading cryptocurrency exchange, regularly burns BNB tokens, using a percentage of its trading revenue.

- Ripple (XRP): While not as frequent as some other projects, Ripple has also conducted coin burns, which they have historically done to help manage circulating supply and value.

- Terra (LUNA): The Terra network used a burn mechanism to stabilize its algorithmic stablecoin UST, which eventually failed due to different reasons.

- Shiba Inu (SHIB): Shiba Inu, a meme coin, has also used coin burning as a method to reduce supply and influence demand in its ecosystem.

“The history of coin burning shows that its effectiveness often depends on the project’s fundamentals and the market conditions,” notes Mark Johnson, a senior analyst at Crypto Insights. “A token burn alone will not fix a project’s structural problems. It’s essential to look at the entire ecosystem and strategy.”

Coin Burn Meaning: More Than Just Deletion

Ultimately, the coin burn meaning goes beyond simply destroying tokens. It is a strategic action that impacts the tokenomics, the value and the community’s perception of a project. As an investor, it is critical to understand these mechanisms fully, considering both the potential benefits and the inherent risks involved. The power of the coin burn lies in its potential to re-shape the supply dynamics of the digital asset market.

Conclusion

Coin burning, while a simple concept on the surface, is a complex strategy with far-reaching implications. Projects use it for various reasons: increase token value, enhance stability, and to engage the community. Whether it is about regular burns, event-based burns, or transaction-based burns, the main aim is to alter the supply and demand dynamics. Understanding coin burn meaning helps you make more informed decisions when investing in cryptocurrencies, and to not base decisions only on limited data. While coin burning can be a powerful tool, it’s just one piece of the puzzle. It’s crucial to evaluate the project holistically, considering its fundamentals, long-term vision, and the overall market conditions, in order to make educated decisions when investing in this market.

Frequently Asked Questions (FAQs)

-

What is a burn address in cryptocurrency?

A burn address is a wallet address with an unknown private key, making it impossible to access any tokens sent to it. This effectively removes those tokens from circulation. -

Why do cryptocurrency projects burn coins?

Cryptocurrency projects burn coins to reduce the supply of tokens, aiming to increase scarcity and potentially drive up the value, stabilize the price, or reward long-term holders. -

How often do coin burns usually happen?

Coin burns can happen at scheduled intervals (monthly, quarterly), be triggered by specific events, or based on the amount of transaction fees generated on the network. -

Does coin burning always increase the price of a cryptocurrency?

While the goal of coin burning is to increase the price, it’s not guaranteed. Market sentiment, project fundamentals, and other factors also influence price. -

What is the difference between coin burning and Proof-of-Burn?

Coin burning refers to the act of removing tokens from circulation by sending them to an inaccessible wallet address. Proof-of-Burn is a consensus mechanism where users burn tokens to earn the right to mine or validate blocks. -

Are there any risks associated with coin burning for investors?

Yes, there is a risk that coin burns might not have the desired effect on the price, and there’s a risk of manipulation. It is essential for investors to do comprehensive research before investing. -

What are some examples of cryptocurrencies that have burned coins?

Binance Coin (BNB), Ripple (XRP), Terra (LUNA), and Shiba Inu (SHIB) are examples of cryptocurrencies that have engaged in coin burning. -

How can I verify a coin burn transaction?

Coin burn transactions are typically transparent and logged on the blockchain. You can check the transaction on a block explorer using the burn address. -

Is coin burning a long-term sustainable strategy?

While coin burning can be a part of a project’s strategy, its long-term sustainability depends on a project’s underlying value, adoption, and the overall market conditions.