Max Leverage on Binance: A Comprehensive Guide for Traders

Navigating the world of cryptocurrency trading can be challenging, especially when considering high-risk, high-reward strategies like using Max Leverage On Binance. This guide will delve into the intricacies of leveraging your trades on Binance, providing you with the knowledge and insights you need to make informed decisions. We’ll explore what leverage is, how it works on Binance, the risks involved, and some tips for responsible trading. Let’s get started! Understanding leverage is key, and it is important to understand the potential gains and losses it can bring to your trading portfolio.

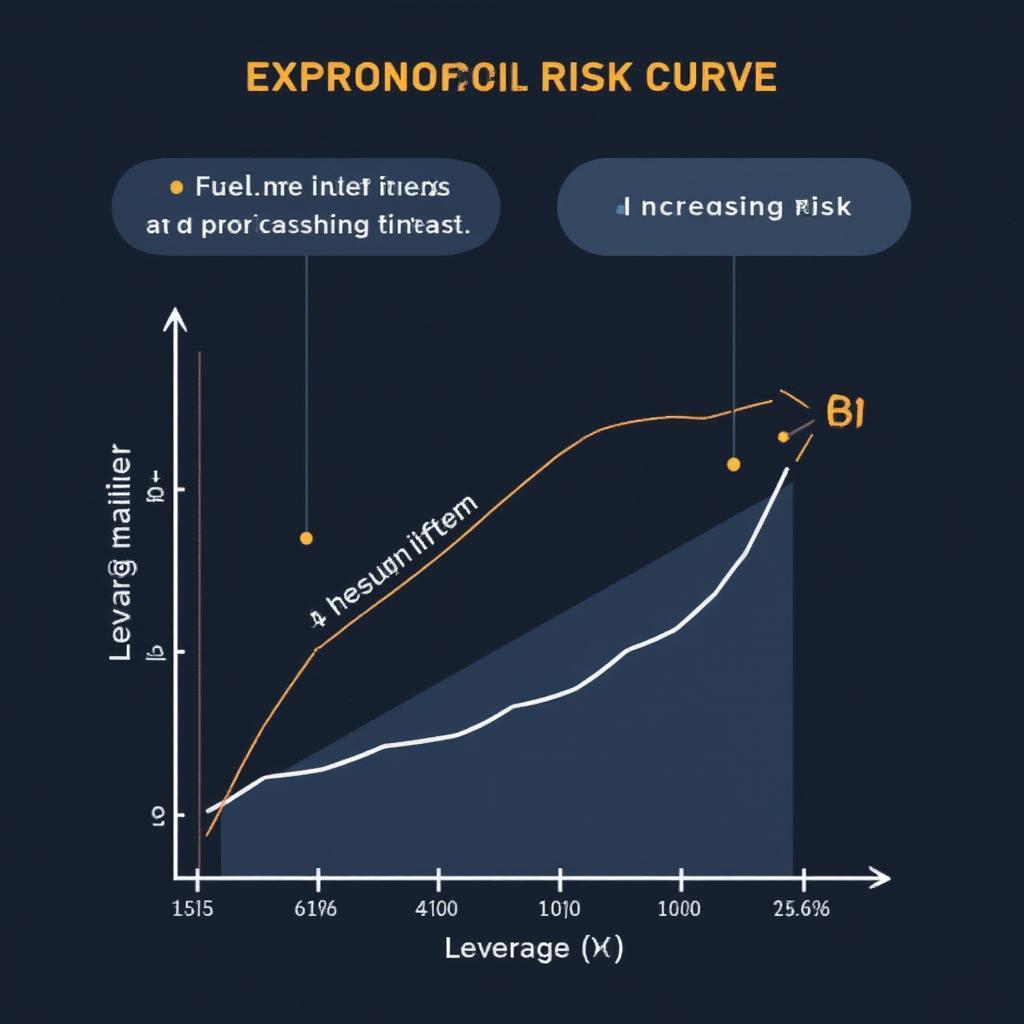

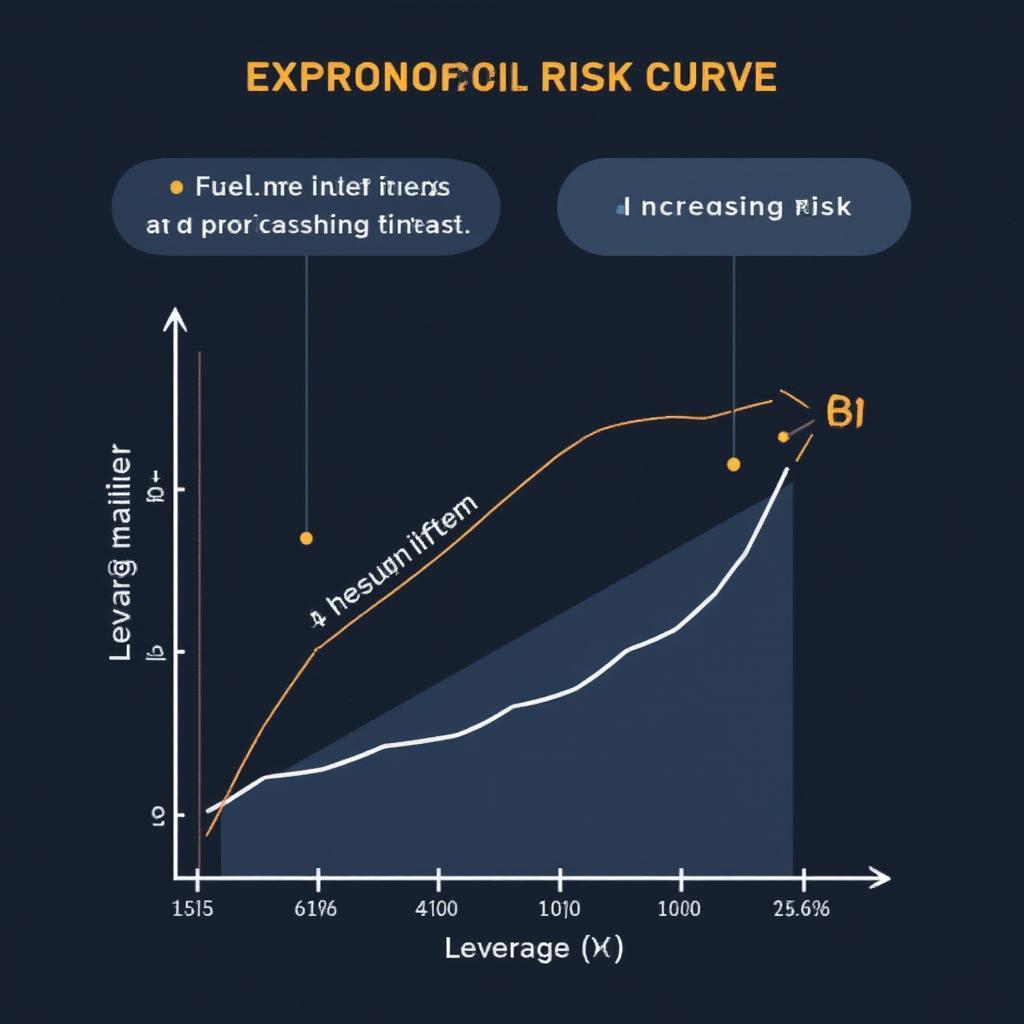

Leverage, in its simplest form, allows you to control a larger position with a smaller amount of capital. It’s essentially borrowing funds to amplify your trading power. On Binance, you can access different leverage options depending on the type of trading you’re engaged in. For example, perpetual futures contracts often offer high leverage levels, while spot trading does not involve leverage directly. The potential for increased profits is attractive, but so is the risk of amplified losses, making leverage a double-edged sword. To better understand the nuances of trading on the platform, check out the article on spot trading binance fees

Understanding Leverage Trading on Binance

What is Leverage and How Does It Work?

Imagine you have $100, but you want to trade $1000 worth of Bitcoin. With 10x leverage, your $100 deposit allows you to open a position worth $1000. This means if the price of Bitcoin goes up by 1%, you make $10 instead of $1. Sounds great, right? However, if the price drops by 1%, you lose $10 – a significant portion of your initial capital. The key takeaway here is that leverage amplifies both profits and losses. It’s not simply a tool for big wins, but a tool that requires precise and informed risk management.

Types of Leverage Available on Binance

Binance offers various leverage options across its different trading products, including:

- Futures: The most common place to find high leverage. You can often find leverage options such as 5x, 10x, 20x, and even 125x for some contracts.

- Margin Trading: This allows you to borrow funds using your existing assets as collateral. Leverage typically ranges from 3x to 10x, or sometimes higher depending on the trading pair. It’s crucial to know the difference between these, as margin trading is often seen as the safest option for leverage.

- Leveraged Tokens: These tokens automatically rebalance themselves to maintain a target leverage level. While convenient, they come with their own risks, particularly during periods of high volatility.

Maximum Leverage on Binance and Its Implications

The maximum leverage available on Binance can sometimes reach up to 125x on specific futures contracts. This means, in theory, you can control a position 125 times the size of your deposit. However, this level of leverage is extremely risky and is more suited for very experienced and risk-tolerant traders, or those seeking short term opportunities. Using such a high level of leverage can result in incredibly fast gains, or just as rapidly, substantial losses. For example, those interested in exploring the maximum leverage Binance has to offer, may want to take some time and read through the binance 125x article.

“When dealing with maximum leverage, you’re playing with fire,” says Arthur Blackwood, a seasoned cryptocurrency trader with 15 years of experience. “It’s not about the size of your potential win but about how quickly you can lose your entire capital. A small market move against you at 125x leverage can be devastating.”

Risks Associated with Using Max Leverage on Binance

Amplified Losses: The Double-Edged Sword

The most critical risk of using high leverage is the potential for amplified losses. As previously mentioned, while profits are multiplied, so are your losses. A minor price fluctuation can trigger a liquidation, meaning your position is automatically closed, and you lose your entire collateral. This can happen very quickly when trading with high leverage, especially during periods of high volatility.

Liquidation Risk: A Constant Threat

Liquidation is the nightmare of every leveraged trader. If the price of the asset you are trading moves against you to a certain point, Binance will automatically close your position to protect itself. The closer your leverage is to the max, the closer your liquidation price will be to your entry point. This leaves little room for error and greatly increases the risk of losing your initial capital. It’s crucial to have a clear understanding of your liquidation price and strategies to mitigate risk, such as using stop-loss orders.

Margin Call and Additional Margin Requirements

In some cases, especially when margin trading, you might receive a margin call from Binance. This is a request to deposit additional funds to maintain your position. Failure to meet the margin call can lead to forced liquidation. Understanding margin requirements and being prepared to handle a margin call is essential for responsible leverage trading.

Emotional Impact and Trading Mistakes

High leverage can increase stress and emotional decision-making. The pressure of potential rapid gains or devastating losses can lead to impulsive trading, often resulting in mistakes that could have been avoided. It’s important to approach leverage trading with a clear strategy and a level head.

Strategies for Managing Risk When Using Leverage on Binance

Start with Low Leverage

If you’re new to leverage trading, it’s always best to start with low leverage, such as 2x or 3x, and gradually increase it as you gain more experience and understanding. This allows you to learn the ropes and develop risk management strategies without risking too much of your capital. You can also check the binance app api to develop your trading skills.

Use Stop-Loss Orders

A stop-loss order is a crucial risk management tool for all traders, but especially for those using leverage. This order automatically closes your position when the price reaches a specific level, preventing further losses. Setting stop-loss orders is a simple yet effective strategy that helps protect your capital. This is particularly important because maximum leverage can be very difficult to manage without strict rules and processes.

Understand Your Liquidation Price

It’s critical to know your liquidation price before entering a leveraged trade. Binance provides this information within the trading interface. Keep track of your liquidation price, and adjust your position sizes to manage risk.

Never Risk More Than You Can Afford to Lose

This is the golden rule of trading, but it’s even more important when using leverage. Only use capital that you are comfortable losing, as the nature of leverage means your whole position could be wiped out very quickly. Don’t trade with funds you need for essential expenses or savings.

Don’t Let Emotions Cloud Your Judgment

Avoid the temptation to trade based on emotions. Stick to your trading strategy, and don’t make impulsive decisions when you are under pressure. If you’re feeling stressed or overly excited, take a break from trading and return to it when you are calm and clear-headed.

“Effective risk management is non-negotiable when using high leverage,” advises Amelia Chen, a respected financial risk consultant. “Always have a clear plan, use stop-loss orders, and manage your risk according to your risk tolerance.”

Practical Steps for Trading with Leverage on Binance

Setting up a Binance Account for Margin or Futures Trading

Before trading with leverage, make sure you have a Binance account and you’ve completed the KYC (Know Your Customer) verification process. This will give you the needed access to the different leverage trading options. Familiarize yourself with the interface for Margin or Futures trading depending on your preference. You can also learn about the various steps in binance set up for further assistance.

Choosing the Right Trading Pair and Leverage Level

Select a trading pair you understand well, and that has sufficient liquidity. Check the markets for the best trade opportunity and only proceed if you have a strong analysis. Start with a low leverage level and gradually increase it as you gain more confidence. Never feel compelled to jump to max leverage.

Executing a Leveraged Trade on Binance

Once you have selected your leverage level and trading pair, place your order. It’s important to double-check all the details before executing your trade. Monitor your position closely, especially during periods of high volatility. Be prepared to adjust your position or close out your trade based on market conditions and your risk management plan.

Monitoring and Managing Your Leveraged Position

Be vigilant and regularly check your position. Keep an eye on your liquidation price. Always follow the market trends and be quick to adjust your strategy as you are able to. Be prepared to close your position when needed.

Conclusion

Using max leverage on Binance can be a very high-risk activity. While it offers the potential for significant gains, it also comes with the risk of rapid and substantial losses. Therefore, It’s essential to approach leverage trading with caution, understanding the risks involved, and with a well-defined risk management strategy. Starting with lower leverage levels, utilizing stop-loss orders, understanding your liquidation price, and managing your emotions are all important for responsible leverage trading. Remember that knowledge and preparation are your best tools when exploring high-leverage trading, allowing you to navigate the crypto market more effectively. The use of leverage can be effective with proper risk management and knowledge of what to expect.

Frequently Asked Questions (FAQs)

What is the highest leverage available on Binance?

The highest leverage available on Binance is typically 125x for some specific perpetual futures contracts. However, this high level is recommended only for experienced traders due to the extreme risks involved.

Is using max leverage on Binance a good idea?

Using max leverage is generally not recommended for beginners due to the very high risk of losing your entire capital. It should only be considered by experienced traders with a very high risk tolerance and a solid understanding of market dynamics.

How can I reduce the risks of using leverage on Binance?

You can reduce the risks by starting with lower leverage, using stop-loss orders, understanding your liquidation price, managing your emotions, and never risking more than you can afford to lose.

What is a liquidation price in leveraged trading?

The liquidation price is the price at which your leveraged position will be automatically closed by Binance to prevent further losses. This happens if the market moves against your position. Always be aware of your liquidation price.

What is a margin call on Binance?

A margin call is a request from Binance to deposit additional funds to maintain your leveraged position. If you fail to meet the margin call, your position could be automatically closed.

Can I lose more than my initial deposit when using leverage on Binance?

Yes, you can lose more than your initial deposit if you do not properly manage your risk. This can happen if you hold your position beyond your liquidation point, potentially resulting in a negative balance. It’s important to manage your risk and to know the binance sys that will effect your trade.

How can I learn more about leverage trading on Binance?

Binance provides educational resources and guides on its platform to help users understand leverage trading. You can also explore articles like this one and other online resources to expand your knowledge.