Porsche 996 Classic Car Insurance: A Comprehensive Guide

Porsche 996 Classic Car Insurance is becoming increasingly relevant as the first water-cooled 911 ages. Understanding the nuances of insuring this modern classic requires careful consideration of factors beyond standard auto policies. This guide delves into the specifics of Porsche 996 classic car insurance, offering insights into coverage options, valuation, and finding the right policy for your prized possession.

Understanding the Need for Specialized Porsche 996 Insurance

While the Porsche 996 might not seem like a “classic” in the traditional sense, it’s rapidly gaining recognition as a modern classic car. This transitional model, produced from 1997 to 2005, marked a significant shift in Porsche’s design philosophy and engineering. Its unique status necessitates specialized insurance that caters to its appreciating value and potential for future collectability. Standard auto insurance policies often fall short in adequately covering these aspects. They may not accurately reflect the market value of a well-maintained 996, potentially leaving owners underinsured in the event of a claim.

Why Your Standard Policy Isn’t Enough

Traditional insurance policies are designed for daily drivers, focusing on liability and collision coverage at a depreciated value. Classic cars, including the appreciating Porsche 996, require agreed value coverage, which ensures you receive the full agreed-upon amount in case of a total loss, regardless of market fluctuations. Furthermore, classic car insurance often offers specialized benefits like roadside assistance tailored for older vehicles and coverage for parts that might be difficult to source for a standard car.

Factors Affecting Porsche 996 Classic Car Insurance Premiums

Several key factors influence the cost of classic car insurance for your Porsche 996. Understanding these variables can help you make informed decisions about your coverage.

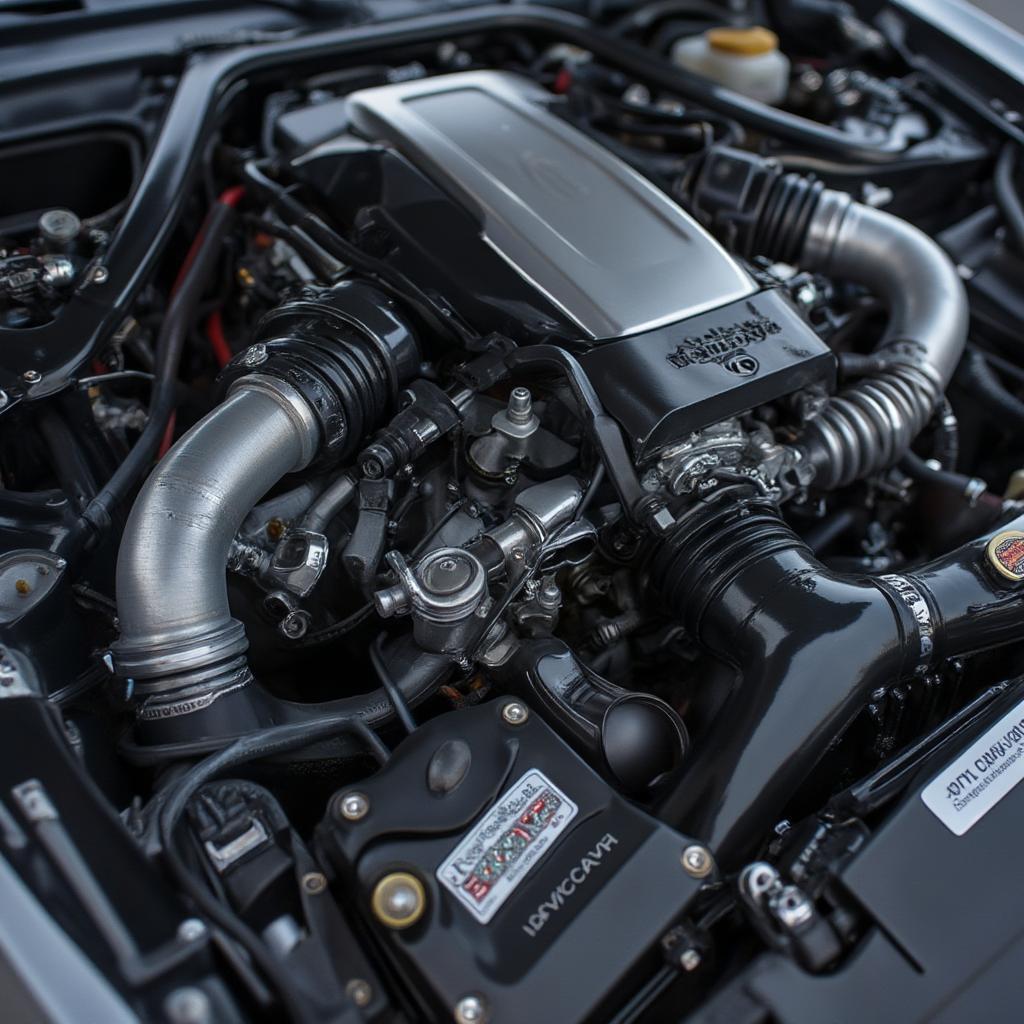

Vehicle Condition and Modifications

The condition of your 996, including mileage, maintenance records, and originality, plays a crucial role in determining your premium. Modifications, especially those impacting performance, can also affect your rates.

Usage and Storage

How you use and store your 996 impacts your insurance costs. Limited mileage policies, often requiring proof of restricted usage, can significantly lower premiums. Secure storage, such as a garage, demonstrates lower risk and can lead to favorable rates.

Driver Profile and Location

Your driving history, including any accidents or violations, is a significant factor. Your location also plays a role, as areas with higher rates of theft or accidents may result in higher premiums.

Finding the Right Porsche 996 Classic Car Insurance Policy

Choosing the right classic car insurance for your Porsche 996 requires research and comparison shopping. Don’t settle for the first quote you receive.

Comparing Coverage Options

Compare coverage options from different insurers, paying close attention to agreed value, mileage restrictions, roadside assistance, and coverage for spare parts. Consider factors like the deductible you’re comfortable with and the claims process.

Working with Specialized Insurers

Seek out insurers specializing in classic cars. They often have a deeper understanding of the unique needs of owners and offer tailored coverage options.

Reading the Fine Print

Carefully review the policy documents before committing. Understand the terms and conditions, exclusions, and limitations of the coverage.

Valuing Your Porsche 996 for Insurance Purposes

Accurately valuing your Porsche 996 is crucial for ensuring adequate coverage.

Agreed Value vs. Stated Value

Opt for agreed value coverage, where you and the insurer agree on the car’s value upfront. This protects you from potential disputes in case of a total loss. Avoid stated value policies, which may offer a lower initial value and leave room for disagreement during a claim.

Appraisal and Documentation

Obtain a professional appraisal from a reputable classic car appraiser. Document your car’s condition, maintenance records, and any modifications with photos and receipts. This documentation strengthens your case for an accurate valuation.

Common Questions About Porsche 996 Classic Car Insurance

What is the average cost of Porsche 996 classic car insurance? The cost varies greatly depending on factors mentioned earlier. However, expect to pay less than standard insurance due to limited mileage and usage restrictions.

Do I need classic car insurance if my Porsche 996 is my daily driver? No, classic car insurance typically requires limited mileage and specific usage restrictions.

How do I find a reputable classic car appraiser? Consult classic car clubs, online forums, and specialized insurance providers for recommendations.

What modifications can affect my insurance premiums? Performance modifications, such as engine upgrades or suspension changes, often lead to higher premiums.

Is it worth insuring my Porsche 996 as a classic car? If your 996 is well-maintained, appreciating in value, and not your daily driver, classic car insurance provides better protection and peace of mind.

What documentation do I need to provide for classic car insurance? You’ll likely need photos, maintenance records, appraisal documents, and proof of ownership.

Can I drive my Porsche 996 to car shows with classic car insurance? Yes, most classic car insurance policies allow for occasional driving to car shows and events.

Conclusion

Securing the right Porsche 996 classic car insurance is essential for protecting your investment and ensuring peace of mind. By understanding the nuances of classic car insurance and following the tips outlined in this guide, you can find a policy that meets your needs and keeps your Porsche 996 well-protected for years to come. Consider contacting a specialized classic car insurance broker for personalized guidance and quotes tailored to your Porsche 996.