Proof of Work on Binance: A Comprehensive Guide

Proof of Work (PoW) is a consensus mechanism used to validate transactions and add new blocks to a blockchain. While Binance is primarily known for its Binance Smart Chain (BSC) which utilizes Proof of Stake (PoS), understanding PoW is crucial for grasping the foundational principles of blockchain technology and the broader cryptocurrency landscape. This article delves into the intricacies of PoW, its relevance to Binance, and its implications for investors.

Binance, while not directly employing PoW for its main exchange operations, supports numerous cryptocurrencies that rely on this mechanism. Understanding PoW is therefore essential for Binance users to make informed investment decisions. This comprehensive guide will explore the core concepts of PoW, its advantages and disadvantages, and how it relates to the Binance ecosystem.

Understanding the Fundamentals of Proof of Work

PoW requires participants, known as miners, to solve complex mathematical problems to validate transactions and add them to the blockchain. The first miner to solve the problem gets to add the new block and receives a reward in the form of cryptocurrency. This process secures the network by making it computationally expensive to tamper with the blockchain. The difficulty of these problems adjusts automatically based on the network’s hashrate, ensuring a consistent block time.

How Proof of Work Secures the Blockchain

The security of PoW stems from the immense computational power required to solve these mathematical puzzles. A malicious actor attempting to alter the blockchain would need to control more than 50% of the network’s hashrate, a feat that is practically and economically infeasible for most established blockchains like Bitcoin. This decentralized nature makes PoW systems resistant to censorship and single points of failure.

Proof of Work Coins on Binance

Binance lists a wide array of cryptocurrencies, including many that utilize the PoW mechanism. Bitcoin (BTC), the first and most prominent cryptocurrency, is a prime example of a PoW coin traded on Binance. Other notable PoW coins available on the platform include Litecoin (LTC), Bitcoin Cash (BCH), and Ethereum Classic (ETC).

Trading Proof of Work Coins on Binance

Binance provides a robust platform for trading PoW cryptocurrencies. Users can buy, sell, and trade these assets using various order types and trading tools. Understanding the volatility and market dynamics of PoW coins is crucial for successful trading on Binance. Factors such as hashrate, mining difficulty, and regulatory developments can significantly impact the price of these assets. Learning technical analysis and implementing risk management strategies are vital for navigating the PoW coin market on Binance. binance swing trading can be a profitable strategy for experienced traders familiar with market fluctuations.

Advantages and Disadvantages of Proof of Work

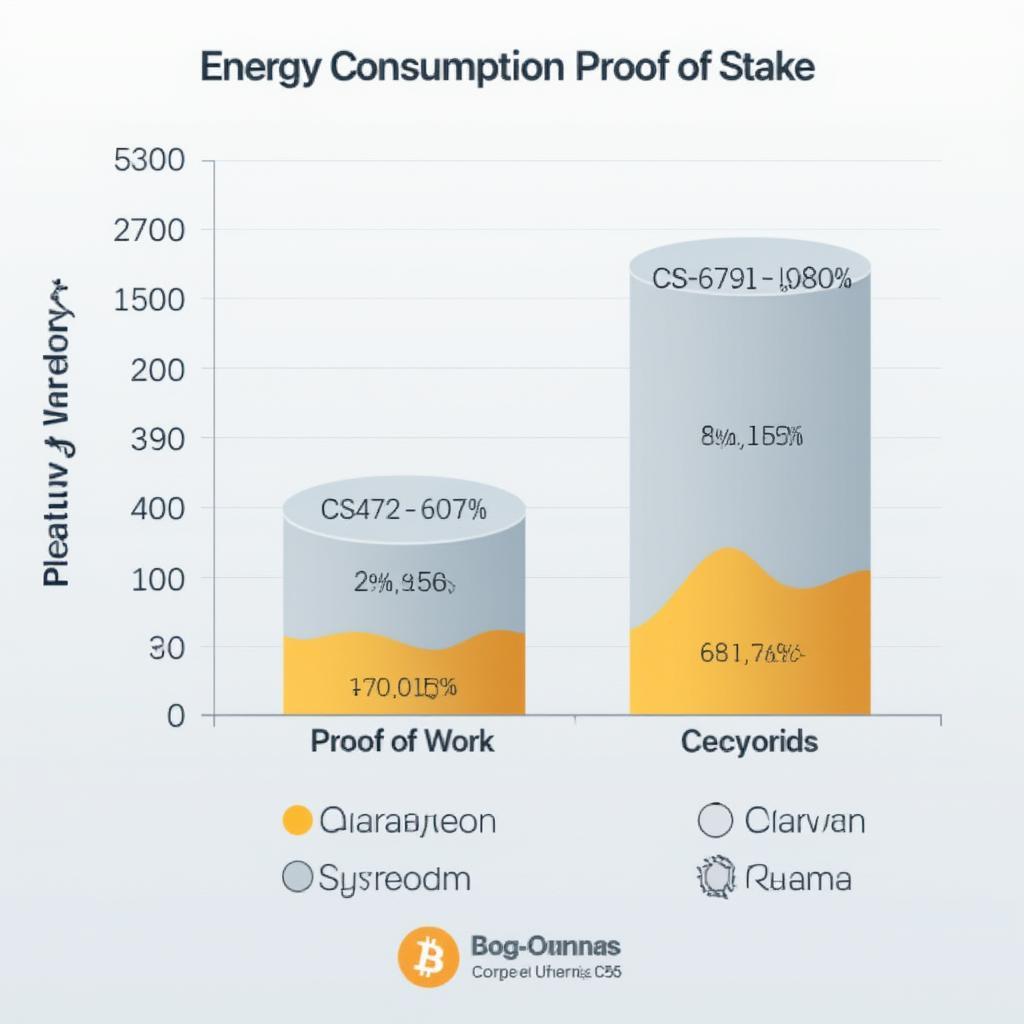

PoW offers several advantages, including robust security due to its decentralized nature and resistance to censorship. However, it also has drawbacks, such as high energy consumption and potential for 51% attacks, though the latter is less likely in well-established networks. The scalability of PoW blockchains is also a concern, as transaction processing speeds can be limited by the block time and network congestion.

The Environmental Impact of Proof of Work

The energy consumption associated with PoW mining has drawn significant criticism. The computational power required to solve complex mathematical problems translates to a substantial carbon footprint. This environmental concern has led to the exploration of alternative consensus mechanisms, such as PoS, which are considered more energy-efficient.

The Future of Proof of Work and Binance

While newer consensus mechanisms like PoS are gaining traction, PoW remains a fundamental pillar of the blockchain ecosystem. Binance’s continued support for PoW coins demonstrates its significance within the cryptocurrency market. The future of PoW likely lies in finding ways to mitigate its environmental impact, potentially through the use of renewable energy sources for mining operations.

“The resilience of Bitcoin and other PoW cryptocurrencies underscores the enduring power of this consensus mechanism,” says renowned blockchain expert, Dr. Amelia Hernandez, Chief Economist at Crypto Futures Institute. “While challenges remain, the security and decentralization offered by PoW continue to be highly valued in the crypto space.”

Conclusion

Proof of Work, while not directly implemented by Binance for its primary operations, plays a critical role in the broader cryptocurrency market that Binance serves. Understanding the principles of PoW, its strengths and weaknesses, and its application in various cryptocurrencies is essential for any investor navigating the Binance platform. By grasping the core concepts of this foundational consensus mechanism, users can make more informed trading decisions and participate more effectively in the evolving world of digital assets.

FAQ

- What is the main difference between Proof of Work and Proof of Stake?

- Why is Proof of Work considered energy-intensive?

- How does Proof of Work prevent double-spending?

- What is a 51% attack in the context of Proof of Work?

- What are the most popular Proof of Work coins on Binance?

- How can I trade Proof of Work coins on Binance?

- Is Proof of Work still relevant in the future of blockchain technology?

- What are the environmental concerns surrounding Proof of Work?

- How does Binance support Proof of Work cryptocurrencies?

“The future of finance is undeniably intertwined with blockchain technology, and a deep understanding of its foundational elements, including Proof of Work, is paramount for success in this dynamic landscape.” – David Lee, Senior Portfolio Manager at Global Blockchain Investments.