State Farm Classic Car Coverage: Protecting Your Automotive Treasure

State Farm Classic Car Coverage offers specialized insurance for vintage vehicles. But what exactly does it entail, and why is it crucial for classic car owners? This comprehensive guide delves into the intricacies of State Farm’s classic car insurance, providing you with the knowledge you need to protect your cherished automotive investment.

Why Classic Cars Need Specialized Insurance

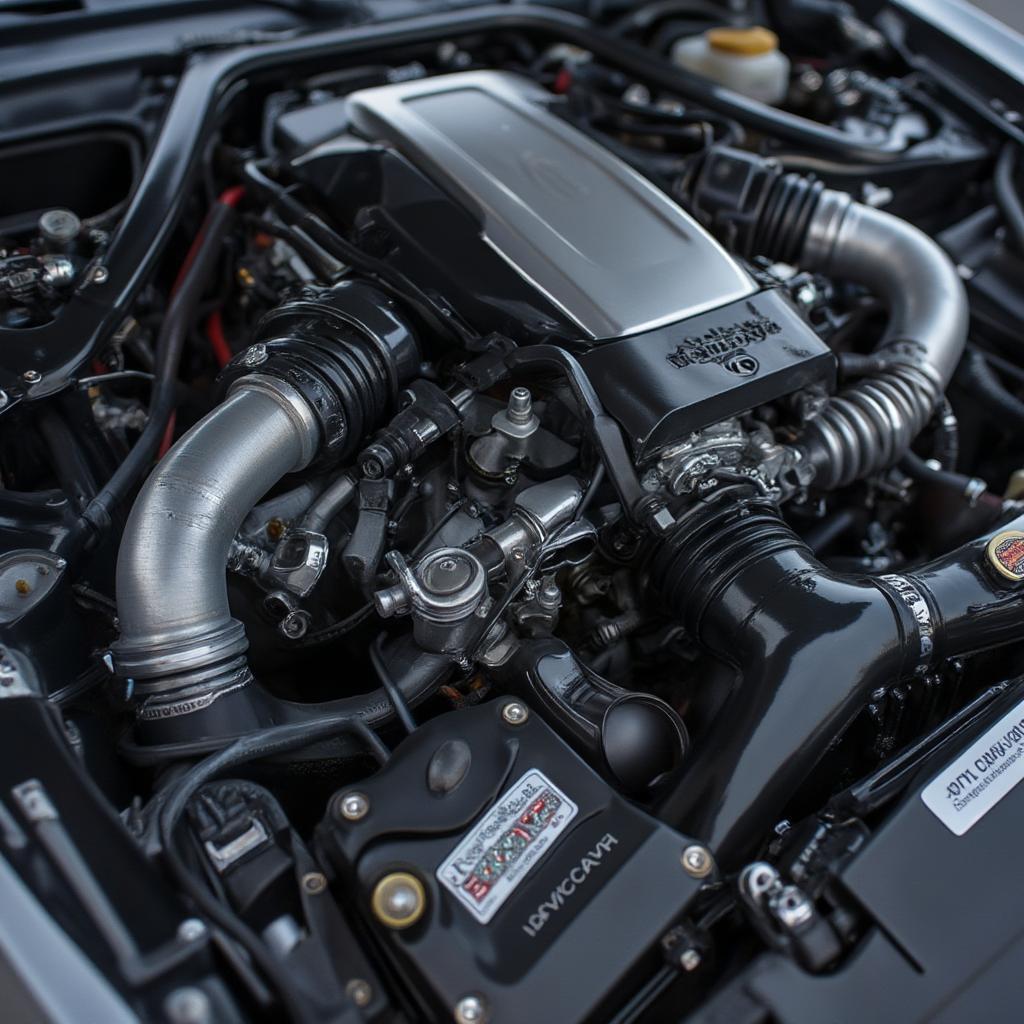

Classic cars, often seen as rolling works of art, require more than standard auto insurance. They hold significant historical and sentimental value, often appreciating in worth over time. Their unique construction, featuring parts that may be difficult to source, necessitates specialized repair expertise and potentially higher repair costs. Standard auto insurance policies often fail to address these nuances, leading to inadequate coverage in case of damage or loss. This is where State Farm classic car coverage comes into play. state farm antique car insurance It offers tailored protection designed to meet the unique needs of classic car owners.

Agreed Value vs. Stated Value: Understanding the Difference

One of the key distinctions of State Farm classic car insurance lies in its valuation method. Unlike standard policies that determine a vehicle’s value based on market depreciation, classic car coverage often utilizes “agreed value” or “stated value.” Understanding the difference is critical.

-

Agreed Value: With agreed value, you and the insurer agree upon a specific value for your classic car upfront. This value is typically based on appraisals, the car’s condition, and its market value. In case of a total loss, you receive the agreed-upon amount, regardless of market fluctuations.

-

Stated Value: Stated value allows you to declare the value of your car, but the insurer retains the right to adjust it based on their assessment. While this offers some flexibility, it may lead to disputes in case of a claim.

What Does State Farm Classic Car Coverage Include?

State Farm’s classic car coverage typically includes comprehensive and collision protection, safeguarding your vehicle against damage from accidents, theft, vandalism, and natural disasters. Liability coverage is also included, protecting you financially if you’re found at fault in an accident.

Tailored Coverage for Classic Car Usage

Recognizing that classic cars are often not daily drivers, State Farm classic car coverage offers mileage restrictions and usage limitations. This can translate into lower premiums, as the car is not exposed to the same risks as a vehicle used for daily commuting. However, it’s essential to adhere to these restrictions to maintain coverage validity.

Roadside Assistance and Other Benefits

Beyond core coverage, State Farm often provides additional benefits for classic car owners, such as roadside assistance tailored to vintage vehicles. This can include towing with flatbed trucks to prevent further damage during transport.

Eligibility Requirements for State Farm Classic Car Coverage

Not every vehicle qualifies for classic car insurance. State Farm typically has specific requirements, such as age restrictions (the car must be a certain number of years old), limited usage requirements, and proper storage stipulations. The car might also need to be in good working condition and maintained to a certain standard.

How to Get a Quote for State Farm Classic Car Coverage

Obtaining a quote for State Farm classic car coverage usually involves providing detailed information about your vehicle, including its make, model, year, VIN, modifications, and appraisal documentation. You may also need to provide details about your driving history and intended usage.

“Classic car insurance is not just about financial protection; it’s about preserving automotive history,” says renowned classic car expert, Arthur Whitman, founder of Whitman Classic Restorations. “Choosing the right coverage ensures that these vehicles can continue to be enjoyed by generations to come.”

Ensuring Your Classic Car is Adequately Insured

Before securing State Farm classic car coverage, carefully review the policy details, ensuring it aligns with your specific needs and the value of your vehicle. Consider factors like the agreed value, coverage limits, usage restrictions, and any exclusions.

Regularly Review Your Policy

As your classic car’s value may fluctuate, it’s crucial to periodically review your policy and update the agreed value as needed. This ensures you remain adequately protected in case of a loss.

“Don’t underestimate the importance of proper documentation,” advises Eleanor Vance, a seasoned insurance broker specializing in classic cars. “Maintain detailed records of your car’s maintenance, restoration, and appraisals. This can be invaluable when making a claim.” state farm antique car insurance Thorough documentation strengthens your position in the event of a claim and can expedite the process.

Conclusion

State Farm classic car coverage provides specialized protection tailored to the unique needs of vintage vehicle owners. By understanding the nuances of this coverage, you can ensure your automotive treasure remains protected for years to come. Don’t delay, get a quote today and secure the peace of mind you deserve.

FAQ: State Farm Classic Car Coverage

- What is the average cost of State Farm classic car insurance? The cost varies depending on several factors, including the car’s value, location, and your driving history. Contact State Farm for a personalized quote.

- Do I need an appraisal for my classic car? An appraisal is typically required to establish the agreed value of your vehicle.

- Can I drive my classic car daily with this coverage? State Farm classic car coverage usually has mileage and usage restrictions. Daily driving may not be permitted.

- What types of classic cars are eligible for coverage? Eligibility requirements vary. Generally, the car must be a certain age, in good condition, and not used for daily commuting.

- What happens if my classic car is modified? Modifications may affect your coverage. Inform State Farm about any modifications to ensure adequate protection.

- Does State Farm offer coverage for classic car shows and events? Specific coverage for shows and events may be available. Inquire with State Farm about specific options.

- How do I file a claim with State Farm for my classic car? Contact State Farm directly to report a claim and initiate the claims process.